It is not a secret that 3D printing has been one of the most discussed industries in the past 6 months and one of the best performers in the past 12 months. There are currently four relatively liquid, publicly traded stocks that represent it: 3D Systems ($DDD), Stratasys ($SSYS), Proto Labs ($PRLB), The ExOne Company ($XONE) and it seems that they are all setting up for higher prices.

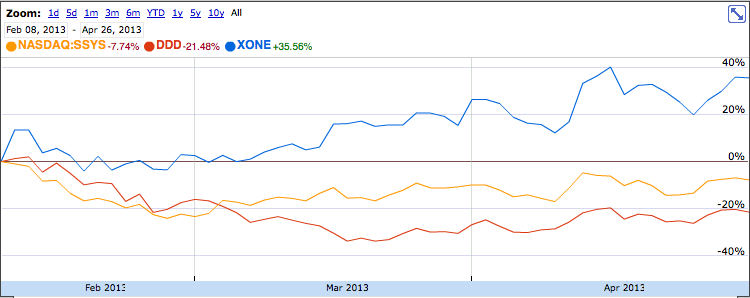

The two big ones $DDD and $SSYS took quite a beating after $XONE had its IPO on February 8th.

There are two ways to look at an IPO in a hot industry:

1) It is positive. It shows that investment banks are confident in market’s ability to absorb the new supply. Stocks from the same industry that are already public often appreciate in anticipation of the new IPO.

2) Too much additional supply of shares is just like overbuilding capacity – it is not a positive in long-term perspective as it puts pressure on prices.

$XONE is a tiny company with current market cap of $500M. It is unlikely to be the major catalyst for the selloff in $DDD and $SSYS. The total market cap of the all publicly traded 3D printing industry is still relatively small for a small surge in supply to matter.

The main reason behind the pullbacks was probably earnings related and not living up to market’s expectations. Mr. Market constantly discounts evens that have not happened yet. As a result, it will often discount events that will not happen. This is not to say that it will remain blind-sighted forever. A good story is not a long-term catalyst. The market gave the benefit of the doubt to $DDD and $SSYS for quite some time and it bid their prices substantially during most of 2012, but it expected those two to start to deliver in terms of real, organic earnings and sales growth. It did not happen, so some dissapointed market participants just took profits and sold, which put downside pressure on the industry.

There was also a sentiment aspect to the pullback. All of a sudden, in January every local TV and radio were covering 3D-printing and talking about its ginormous potential. Wall Street loves to sell to front page headlines after a substantial move.

In March, both $DDD and $SSYS bounced near their rising 200dmas, where long-term buyers typically step up to support their holdings. Since, then they have been under quiete accumulation. Granted, they still have a lot of work to do in the process of building the right side of their new basis, but the whole sector seems to be setting up again.

From technical perspective, both $DDD and $SSYS had at least a couple of tight consecutive closes and have recently broken their downtrends to the upside. They have been making higher highs and higher lows.

$PRLB has been consolidating after its monstrous earnings gap in February and above $50, it could fly again. It has a small float of only 19M shares, which is a prerequisite for volatile moves.

It is earnings season, so don’t forget to check their earnings dates.