Discipline should always trump conviction and personal opinions, the rules are the rules, but you also have know when it is worth to break them. Ceteris paribus, a momentum setup is not complete until certain price level is not breached. Buying before that is usually referred as cheating and often has very high opportunity cost, meaning that you park money in a non-moving asset and miss on other assets that are in the process of rapid appreciation/depreciation.

With all that in mind, there are times when you could afford to “cheat” your momentum system and buy before a breakout has occurred. The price action in the past two weeks reflects exactly this type of market environment. Here what the underlying reasoning behind this approach is:

Currently, there are a lot of underinvested hedge funds and individuals who are looking to increase their equity exposure. Those with technically driven approaches will take a good look at a bunch of charts and they will realize quickly that many stocks look extended and are not appealing at all from risk-to-reward perspective. Then, they will move their attention and capital to stocks that are hovering near important technical levels, but haven’t broken out yet. As they nibble here and there, those breakouts will materialize and even more money will enter as price pivots are cleared. With other words, buying in anticipation of a breakout is likely to have very high success rate.

This is one of the reasons why sector rotation is a major characteristic of all market uptrends. Money moves from extended groups to stocks that are perceived as safer, meaning setups that offer better risk/reward ratio. And the cycle goes on until enough people decide that valuations are too steep and start cashing out.

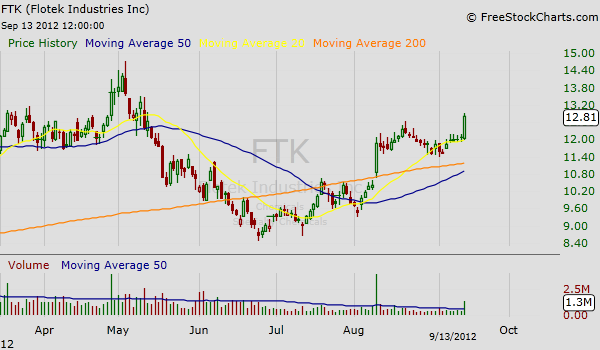

This is why buying setups like $FTK before they have broken out is worth it in this environment. Looking for recent contraction in range and volume will improve your odds of success.

If you understand the average market participant’s incentives, you are likely to gain a very good idea of his next step. Granted, the market is never as easy as it seems on the surface and nothing could replace proper risk management. If a position turns against you, cut it and don’t just sit there like a deer in headlights, hoping that the overall market strength will bail you out.

One thought on “When Buying in Anticipation of a Breakout Makes Sense”

Comments are closed.