It seems that liquidity is a massively misunderstood subject as I am constantly getting questions from the type “Isn’t that stock too thin to be considered”. You have to ask yourself how much liquidity do you actually need for your account and market approach. Here is what you need to know about liquidity in order to answer that question.

1) Liquidity is cyclical and it follows price. Many big winners have started with trading under 100k shares a day or even under 50k. Volume comes with price appreciation. When there is a catalyst behind the price move like strong, unexpected earnings growth or new contract or change in regulations that will lead to strong earnings down the road, liquidity and institutional interest follow.

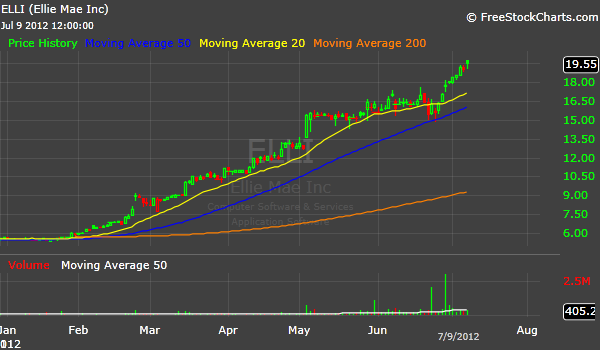

One of this year’s best performing stock is $ELLI. It traded about 20k shares a day at the beginning of 2012. It currently trades close to 350k shares a day.

2) The needed liquidity depends on the size you trade and the amount you manage. The really big institutions cannot afford to accumulate any positions in individual small cap names that trade under 1 million shares a day. The sheer size of their capital makes it impractical to even consider buying small caps. Even if they manage to scoop some shares of a small cap and it doubles, it won’t make a difference for their overall portfolio return.

When it comes to smaller firms that manage under $250 million, things look completely different. Smaller institutions understand the power of sudden acceleration in earnings and are not afraid to nibble on relatively low liquid names. Their cumulative buying power gives a start to new price trends and price appreciation attracts more liquidity over time.

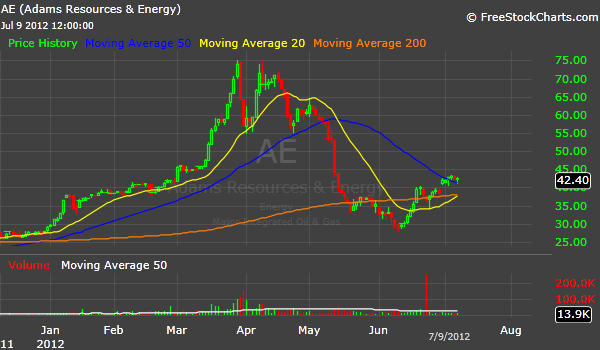

3) You need a proper exit strategy when you deal with relatively low liquid stocks, especially if the move is purely momentum driven and there is no clear catalyst to support it. Smaller market cap, lower float and lower liquidity help tremendously on the way up and exacerbate the move, but turn into a huge disadvantage on the way down. Liquidity tends to disappear just when you need it most. Partial exits onto strength is a very rational approach when dealing with a stock like $AE.

4) Stocks with lower liquidity often trade cleaner and provide “text-book”-like setups that seem too good to be true. It happens every year and they become some of the best performers. They start slow and liquidity comes gradually as unusual price appreciation attracts more attention.

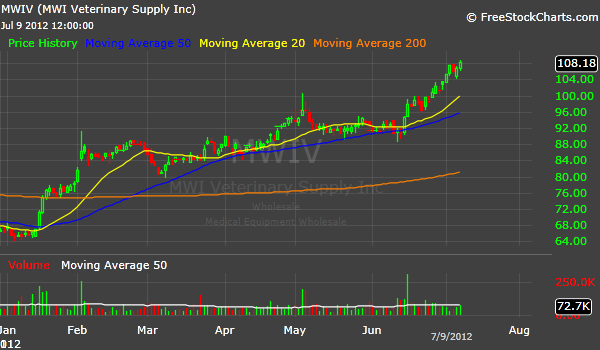

5) Dollar volume is a better measure of liquidity than volume alone. $MWIV used to be a $70 stock that traded about 70k shares a day, which amounts to a 5 million dollar volume. Most people don’t pay attention to stocks trading under 100k shares a day, when in fact $MWIV’s dollar trading volume is the same as the one for a $7 dollar stock that trades 0.7 million shares a day. A lot of good setups could be found among high priced stocks trading under 100k a day.

2 thoughts on “Five Things You Need to Know About Market Liquidity”

Comments are closed.