Change of character refers to a potential change of a longterm trend. One simple way to find stocks that could be labeled as such is to scan for:

- 5%+ movers

- on higher than the average volume

- if they make new 20-day high, this is a bonus that improves the odds of success

The same criteria could be reversed and used to find short candidates.

This equity selection approach involves higher risk, but the potential reward could sometimes be justified, because you could catch a new trend at the very beginning of its development. In today’s fast paced market, “repricing” tends to happen lightningly fast. 80-90% of the move happens in 15-20% of the days one trend is sustained. The rest is nothing else but noise in a range. The fastest price appreciation or depreciation happens at the beginning and at the end of a trend.

It is true that you don’t have to be first to notice a new investment theme in order to profit from it, but in today’s environment of frequent fading the 52week high breakouts, it is wise to have another approach to find trading candidates.

Don’t buy anything blindly. Always think in terms of risk to reward. Risk a $1 to make $4.

The most important trading or investing advice I have ever received was to “never say never”. It helps me not to argue with the market when it tells me that I am wrong.

My “change of character” list from today follows below:

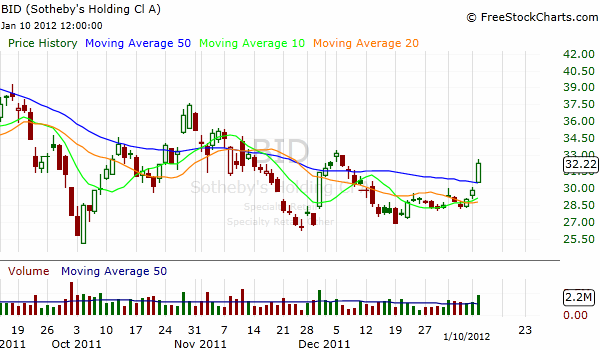

$BID – Auction house for high-end art. Missed earnings last quarter.

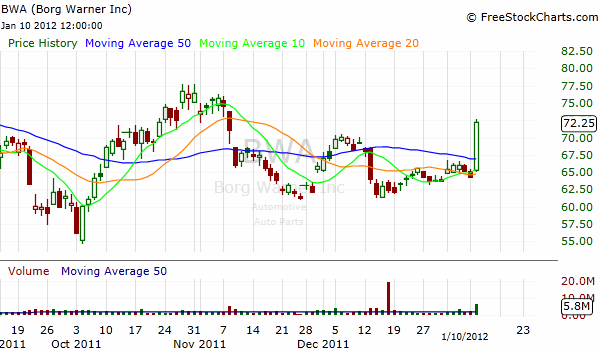

$BWA – Auto parts supplier. Very cyclical business.

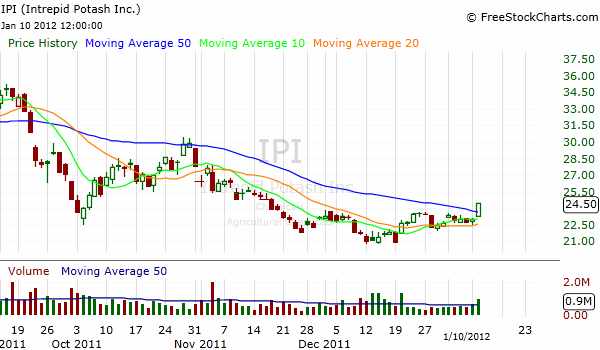

$IPI – US potash producer. The whole fertilizer group has staged a comeback as of late

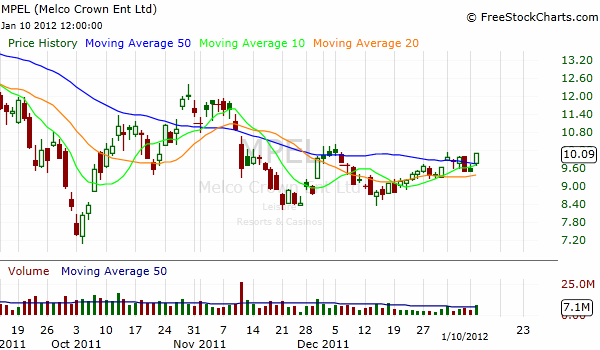

$MPEL – Casino operator in Macau. Asia continues to be the single bright spot for the industry.