The year is still young and there are already some interesting divergences between assets with high historical correlation. The textbook definition of an uptrend is a low correlation market aka market of stocks. I don’t want to make any striking conclusions based on a few days of data, but here is what I am seeing so far:

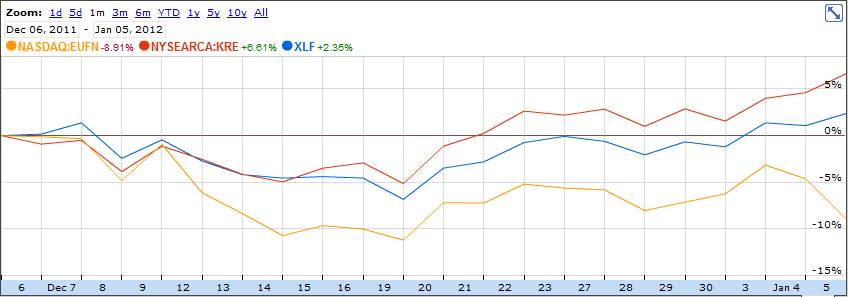

1. U.S. Financial stocks have their issues, but in 2012 they are like a breath of fresh air compared to their European counterparts. The number of regional U.S. bank stocks ($KRE) near 52week high continues to expand, while in Europe the most popular bank has become the mattress ($EUFN). Maybe this is why all home furnishing stocks are doing so well at the start of the year ($SCSS, $TPX, $LZB, $PIR..)

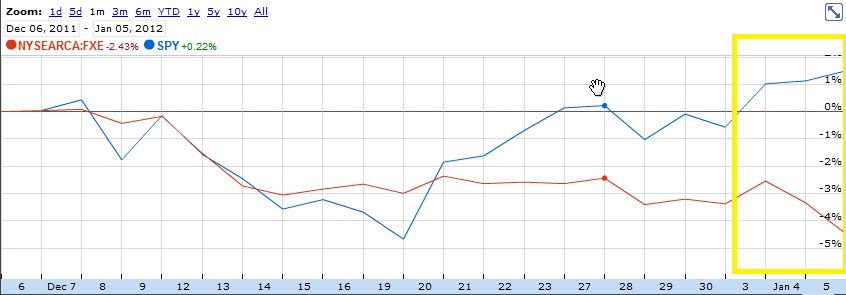

2. U.S. equities and the Euro Index ($FXE) are parting ways for the first time in years. Over the past 6-7 years, there has been very strong correlation between the two, backed by trillions of dollars of carry trade money. The divergence here is certainly a major change of character that will impact the capital allocation of a lot of macro managers.

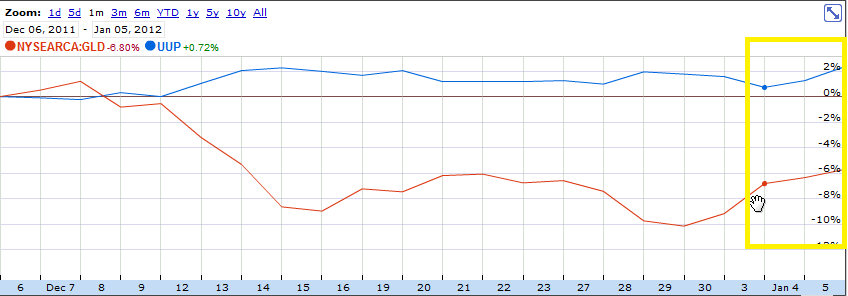

3. The U.S. Dollar Index ($UUP) and gold ($GLD) are rising together. This has happened before, but not for an extended period. No major conclusions to make here. Just a temporary blip that will be arbitraged over time.

And finally for dessert, $SPY and the Shanghai Composite have separated paths once again. In the past, $SPY has been the index to follow Shanghai. Only time will tell if the situation today will be any different. As the saying goes, divergences could continues longer than you could remain solvent.

One thought on “2012 – The Year of Divergences”

Comments are closed.