I have talked many times here that strong price moves are supported by a sequence of catalysts that change market participants’ perception of value and attract new buying interest. The initial market reaction to a catalyst tells a lot about the future price action in a stock. Let’s take a closer look at a typical setup I am looking for every day:

1) There is a strong catalyst (in this case, earnings’ guidance above the consensus estimate)

2) The stock opens close to a new 6 month high (multi-year high is preferable)

3) Short interest ratio is decent (5.5 days in the case of $CRM)

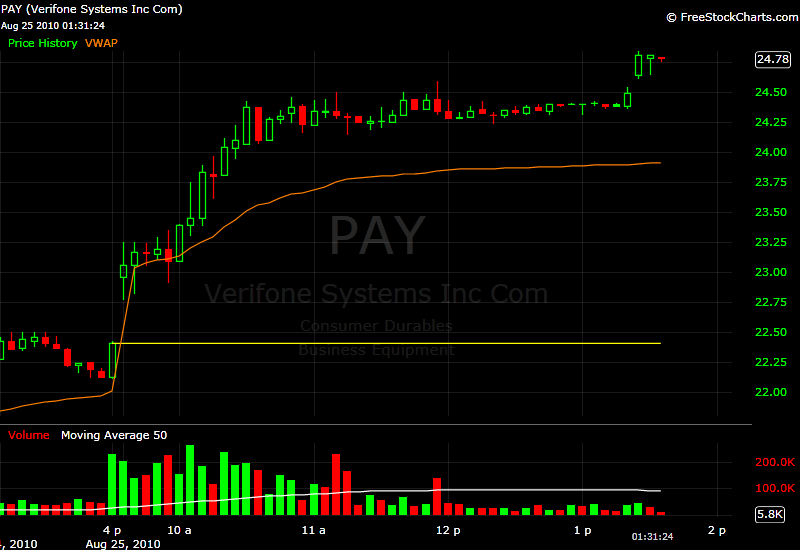

4) There is an initial surge in price on very high volume

5) Consolidations are on low volume above the daily vwap

6) There is a second surge later in the day, allowing the stock to closes at the highs of its daily range.

It pays to be underlined that this setup will not work every time. There is no setup or pattern or check list that always works. The success rate is cyclical. This is why risk management is so essential. It takes you out at a minor cost from a trade that didn’t work out as expected. Recent example for me was $FMCN, which I mentioned on the StockTwits stream yesterday. The stock had high short interest ratio and at some point broke out to new 52 week high, only to reverse later in the day. My unrealized profits evaporated and I had to exit at a minor loss. Losses are natural part of the game; therefore they should not be taken personally.

From a 10,000 foot view ,in order to be a consistently profitable market participant, all you need to do is to find one good setup a day ( or a week or a month – depending on your trading/investing horizon).

When there is a fresh catalyst, the overall market weakness is irrelevant for the day. The most recent example is $PAY. About half an hour before market open, I mentioned on StockTwits:

ivanhoff $PAY beat and raised guidance. Close to 52week high; 10d short interest; neutral mkt reaction so far. I will keep an eye on it. Aug. 25 at 7:51 AM