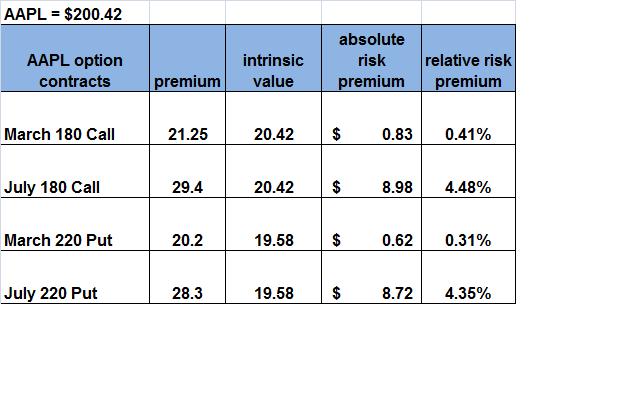

Options that are at least 10% in-the-money and have less than 4 weeks until expiration are usually offered for about 1% risk premium. Take a look at the table below. AAPL 180 March Call is currently trading for $21.25, which means that if purchased, the buyer of premium is paying $0.83 above intrinsic value for the right to buy AAPL at 180 until March 19, when it is expiration date.

$0.83 per share more is an insignificant premium to pay for the leverage that the ITM option offers if AAPL start increasing between now and March 19.

$0.83 per share more is an insignificant premium to pay for the leverage that the ITM option offers if AAPL start increasing between now and March 19.

Buying 100 shares of AAPL will currently cost $20,042

Buying one AAPL 180 March Call will cost $2125

Let assume that AAPL will increase by 10 points to 210.42 between now and expiration date.

The equity position will deliver 10/200.42 = 5% gain

AAPL 180 March call will cost $30.42, which means a gain of 43%

For less than 0.5% of the value of the underlying stock, you are buying the right to have 8.5 times leverage if AAPL goes up.

In absolute terms, the potential reward is similar: 100 shares rising 10 points will net $1000 gain. One AAPL 180 March Call at 30.42 will net $917. The difference is the size of the allocated capital. By purchasing the ITM Call you have much more capital left for other ideas.

Certainly, it is not given that AAPL will increase in value. What will be the consequences if the stock starts declining?

It does not matter if you own 100 shares of AAPL and you got stopped at 195.42 for $500 loss or if you own one AAPL 180 March Call and you got stopped at 16.25 for $500 loss. The risk in absolute terms is the same = $500, assuming that you risk 0.5% of your trading capital per idea and your current trading capital is 100k.

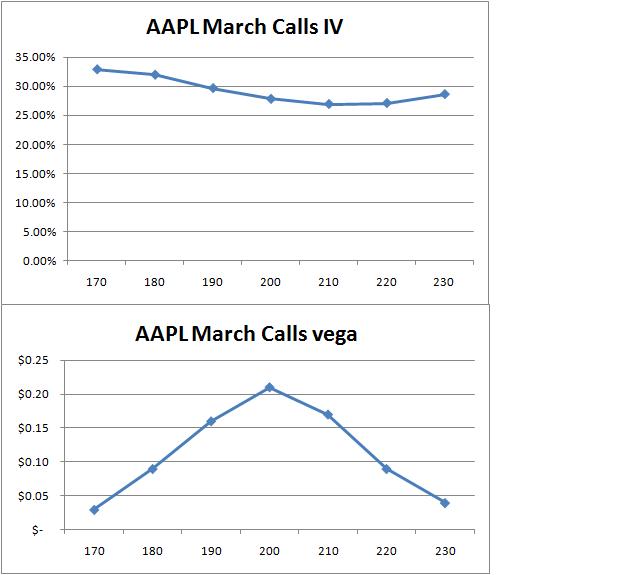

Buying ITM options is strictly directional trade. You have to be right in order to make money. The beauty of the ITM option is that you are essentially paying almost no risk and time premium; therefore your position won’t be seriously harmed by a decline in IV or by theta. You have the privilege to wait almost till expiration date without having to take a significant hit. This is why I like buying ITM options versus OTM options for purely directional trades. With ITM I don’t have to worry about IV and time too much. Unless you are expecting a significant spike in IV, you would be better off by buying 4-5 deep ITM options as opposed to tens or hundreds of OTM options.

In the next post, I will talk about buying and selling premium via vertical spreads. I will address the importance of liquidity and IV for these trades. Here is a quick preview on the subject: