In the United States and many other industrial countries, the recent financial crisis contributed to the longest and most severe economic contraction since the Great Depression. The rapid expansion in the use of borrowed money, or leverage, by households in recent years, is one factor that may help account for the virulence of the downturn.

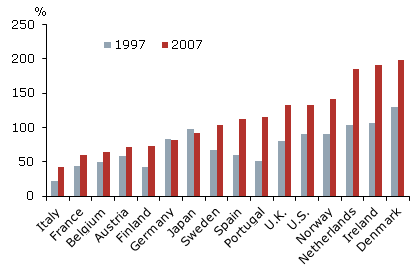

Household leverage ratios: Debt/Disposable income

Going forward, the efforts of households in many countries to reduce their elevated debt loads via increased saving could result in sluggish recoveries of consumer spending. Higher saving rates and correspondingly lower rates of domestic consumption growth would mean that a larger share of GDP growth would need to come from business investment, net exports, or government spending. Debt reduction might also be accomplished via various forms of default, such as real estate short sales, foreclosures, and bankruptcies. But such deleveraging involves significant costs for consumers, including tax liabilities on forgiven debt, legal fees, and lower credit scores.

Source: FRBSF Economic Letter, Reuven Glick and Kevin Lansing