Predictions are very one-dimensional. You are either right or wrong and as we know from George Soros this is not the most important thing in investing. It is far more important how much money we make, when we are right and how much we lose when we end up being wrong.

There are two main approaches to forecasting – you either assume that current trends will continue or they will violently reverse. I have no idea what 2015 will bring and I don’t have to in order to have another great year. I believe in conditional thinking – if this happens, then this is what I am going to do. When the proper setups show up, I take them. With that in mind, here are my educated guesses on what 2015 could bring.

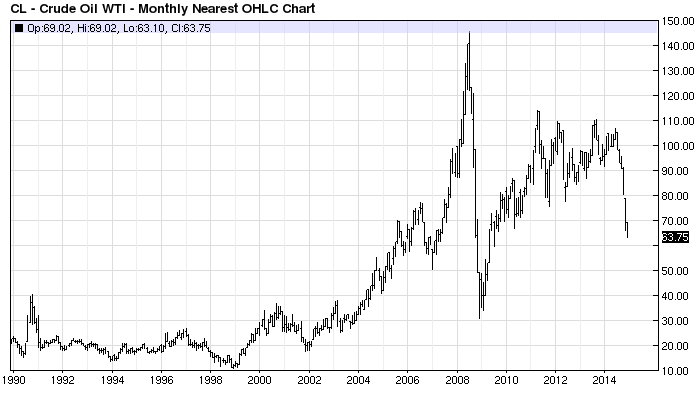

1. Crude Oil will stabilize, but stay under $70 during the entire 2015. This will create positive environment for consumer discretionary stocks.

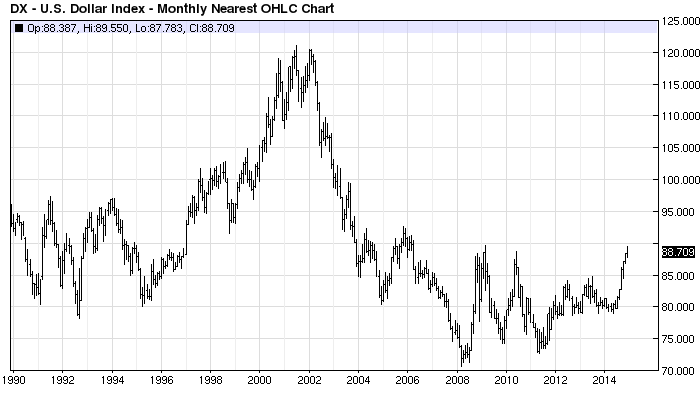

2. The U.S. Dollar will get even stronger against all other major currencies. Everyone else will have to QE to boost economic growth. Japan has already launched the biggest QE program in the world history (for the size of its economy). China is cutting interest rates and ready to devalue the Yuan. The ECB will likely start buying government bonds. Yes, the U.S. Dollar has had big jump in 2014 and it could use some form of consolidation, but over the next few years, it is the best house in a bad neighborhood. It’ll rise against all other currencies.

3. Cheap oil is a huge tailwind for China, India and Europe. China was supposed to crash in the past few years. Guess what? It did. The Shanghai Composite is essentially flat for the past 5 years, while the Chinese economy grew at 7-8% annually. The Chinese GDP has almost doubled for the past 5 years, while their stock market has been a dud. Things started to stir up in late 2014 and we will probably see The Shanghai Composite catching up and continuing to outperform in 2015.

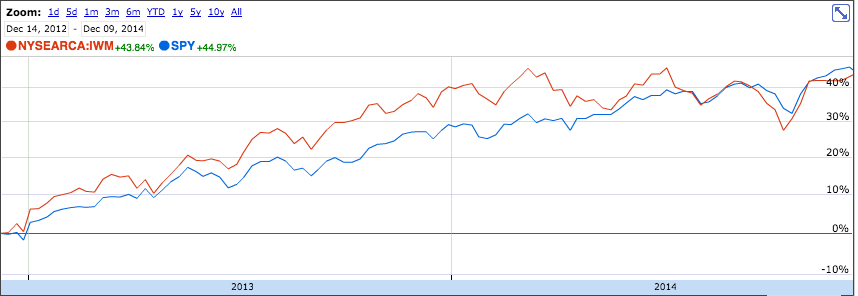

4. Small caps will outperform, at least in the first half of the year. Large caps will probably be flat for the year. Small caps have spent the last 10 months building a potential launching pad after their big year in 2013. If IWM clears 121, the chase will be ON and momentum leaders will crush the market averages.

5. Biotechs will continue to be in the spotlight.IBB has been overdue for a big pullback for quite some time, but it could easily go a lot higher. The biotech ETF IBB is up more than 200% for the past 3 years. The last time a major sector tripled in such period of time was in the mid to late 90s with technology. Do you know what happened after that? The Nasdaq Composite doubled again before it crashed. Maybe, we will see something similar in biotechs. We will probably see a substantial pullback right before tax deadline in April as people sell their big biotech winners to pay Uncle Sam.

6. The market averages will see at least two deeper than 10% corrections during the year. This is usually a safe bet, as it has happened almost every year. As always, the absolute best time to put on long-term positions is after the market averages are down >10% and select stocks start to break out to new 52-week highs from proper bases.

Check out my latest book: “The 5 Secrets to Highly Profitable Swing Trading”

Photo Credit: circulating