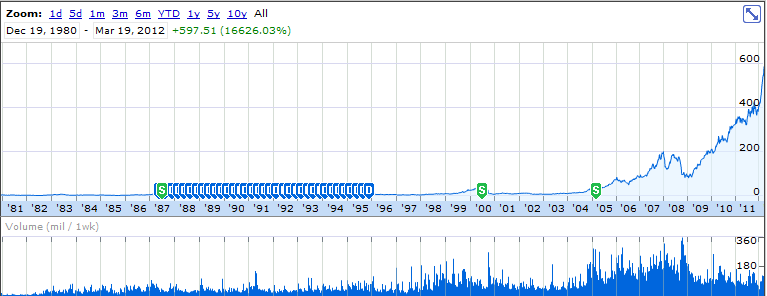

Today, Apple announced that it will join the club of dividend-paying corporations. Many have forgotten that this is not the first time the tech giant gives back part of its cash to shareholders. Apple was paying dividends on a regular basis between 1987 and 1995. In this 8.5 years period Apple actually losses 11% of its market cap. Curiously, Steve Jobs wasn’t at Apple at the time. He left the company in 1985 and didn’t come back until 1997.

My initial reaction to the news was a bit emotional:

I still think that Steve Jobs would have thought of a more creative way to use the cash. Build a small factory on U.S. soil for example for a tax-free treatment of Apple’s $50 Billion that sits overseas.

The surest winner of Apple’ new dividend policy is the government due to the double taxation involved, first on a corporate level and then on a shareholder’s level. There is a reason why Warren Buffett has never paid a dividend. Companies that know how to use their cash do a favor to their shareholders when they don’t pay them a dividend and reinvest their money in their name.

On a second thought, the payout is relatively small and Apple still have enough cash to run its operations and pursue strategic acquisitions. The introduction of a dividend will open the doors for a whole new set of potential buyers. I have a suspicion that Tim Cook is not trying to manage actively just Apple – the company, but also $AAPL – the stock. This is good news for shareholders in short-term perspective. I am not so sure it will be a big positive in long-term, but few on Wall Street care about the distant future.

2 thoughts on “This is Not the First Time Apple Pays Dividends”

Comments are closed.