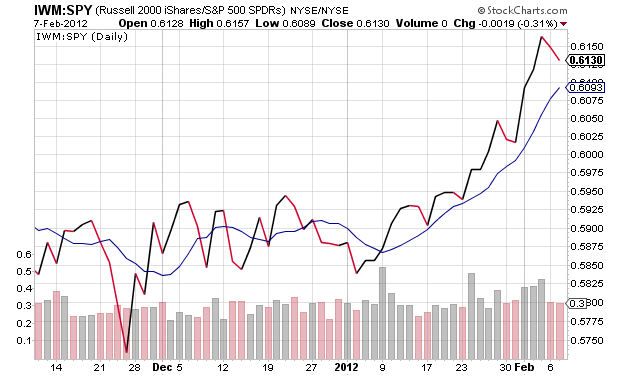

1. Small Caps ($IWM) have been severely underperforming over the past 3 weeks, essentially reflecting a new stage in the current uptrend – the so called flight to quality. This is not necessarily a bad sign, but a clear indication of decreasing risk appetite, which tends to feed on itself.

2. The major indexes ($SPY, $QQQ) had 3 distribution days in the past 13 days, which is certainly a reason for caution, but not for turning outright bearish yet.Tops in market averages are a process, not an event. Price/volume action gives enough clues before any major damage is caused.

3. There is a decent number of long setups that look like a Picasso – prior uptrend, followed by 5-20 days of tightening sideways price consolidation near major highs and yet very few of them actually break out. Those that do, are short-lived and quickly fade. Buyers don’t have the conviction to step in and push higher.

There are no reasons to turn outright bearish here. It seems that institutions are waiting for a pullback before allocating more capital. I assume that dips in high-growing names will be welcomed as buying opportunities, but in the meantime I raised cash this morning and pulled out of positions that haven’t performed according my expectations.