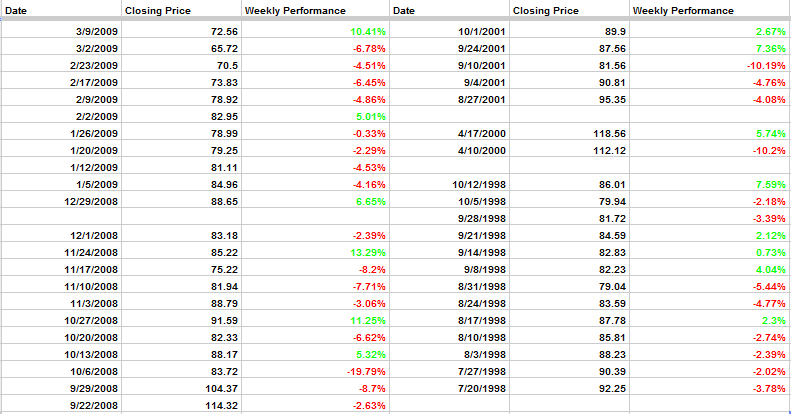

Another 6.5% loss for $SPY, following 7% drop last week and 4% decline the previous week. The charts of the three biggest banks in U.S. – $BAC, $JPM, $WFC look like the Niagara Falls. The $VIX is up 150% for the past three weeks. If this is not panic selling and forced liquidation, I don’t know what it is. As a reference point, take a look at the performance of some of the worst periods for the stock market over the past 15 years.

We are overdue for a bounce technically, but it could easily get worse before it gets any better. The market needs a catalyst to rip higher. It could be news for another edition of quantitative easing. There is nothing else left actually, for both Europe and U.S.

They say that liquidity trumps fundamentals. It is true. The problem is that mood trumps liquidity and currently the mood is dark, for various reasons. During periods of forced liquidations, no price is too low, no stock is too cheap, at least from my perspective.

Value investors live for selloffs like these and if they have any capital left after trying to short the momentum rockets over the past 2 years, they must be stalking for new buys. Valuation is not a catalyst for me, so I stay on the sidelines. Most I’ve done over the past 2 weeks, has been intraday and overall I haven’t managed to appreciate my capital. Probably because I was foolish enough to go against the trend and buy as I should have been sitting on the sidelines or shorting. Sometimes is hard to follow your own advice. I rarely make money being short, so I rather not to.

What is the game plan for the rest of the week? We are still in a correlation 1.0 market, meaning that if the market continues to fall, most stocks are likely tumble and if it bounces, most will follow to the upside; therefore I will focus my attention to two trading vehicles: $SSO and $VXX. If I do anything, I would risk 1/4 of my usual position as the current volatility has elevated significantly the daily range.

The main goal during bear markets is to survive and protect capital. There will be better times to be aggressive.