The number of distribution days in the major market indexes continues to grow as the names that led the rally over the past 7 months, took quite a beating over the past week – semiconductors, oil, basic material, small caps. I noticed a lot of shake-outs on different time frames: a stock breaks out from a range, only to reverse quickly and go below the bottom of the range, essentially shaking out a large number of shareholders. And just when the setup looks broken, the stock rallies back and makes a huge move. You have to observe and adapt quickly. Every setup has a different success rate in the different market environment. If you are not flexible enough and would like to stick to the one setup that you know well, you are better off to stay on the sidelines and wait for the fat pitch.

Sometimes stocks need more time to consolidate. In a strong “risk on” environment, most momentum stocks find buyers at their rising shorter-term moving averages – 5, 10 and 20. When the sentiment changes, the shorter MA become irrelevant. The market action is choppier and it takes more efforts to achieve less.

What was hot last week?

Drug manufacturers had a monstrous week: $CBST, $VRUS, $PTIE, $KV-A

Airlines bounced from hell after crude oil stopped advancing (they are still in a downtrend)

Soda companies are holding well: $PRMW advanced more than 40% on Thursday and Friday as the $SPY lost 1% for the same period. $SODA is trading close to its all-time high.

The Earthquake in Japan will play the role of a catalyst for the world to review its energy policy. The overall short-term implications for oil, coal and natural gas are uncertain. What is clear is that Japan’s refineries are down and they will have to import gasoline from somewhere. The stocks of U.S. refiners might benefit: $WNR, $ALJ, $VLO, $TSO, $SUN, $HOC among others.

In the st50 we noticed the number of apparel retailers on the list is growing as many of them managed to escape mostly unscathed from the recent sell-off.

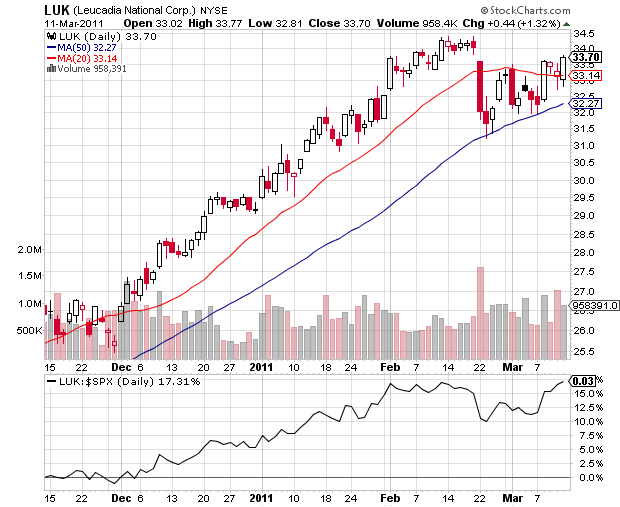

Some of the best looking swing long setups in the latest edition of the St50 are: $LUK, $TBL, VRX,$HYC, $PAY, $EL, $WFMI, $RL

One thought on “Industry Momentum Review”

Comments are closed.