There are not many industries, which stocks experience as much turbulence as the airlines. Airlines stocks are highly cyclical and their price moves are highly dependend on the price of oil. The past year was a roller coaster for many members of the Major & Regional Airlines groups. Many experineced moves from -80% to +300%, several times.

There are not many industries, which stocks experience as much turbulence as the airlines. Airlines stocks are highly cyclical and their price moves are highly dependend on the price of oil. The past year was a roller coaster for many members of the Major & Regional Airlines groups. Many experineced moves from -80% to +300%, several times.

I know what most of you think. Why do I even bother spending time on these industries. Their business must be dead in times of risk-averse consumer and relatively high fuel prices. Well I don’t know if it is for good or bad, but there is sizable difference between the business and the actions of the underlying stock.

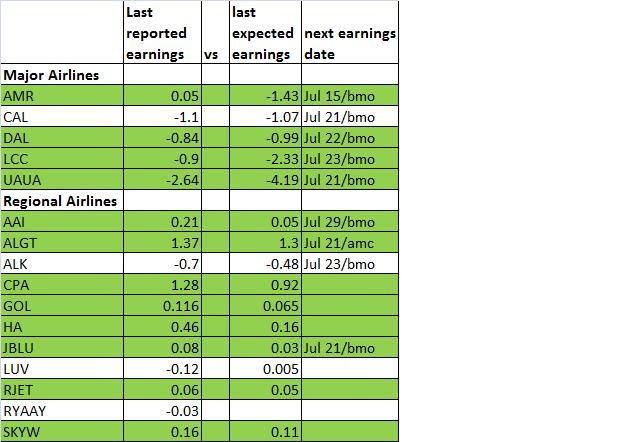

I have the habit to follow earnings surprises and growth in the context of different industry groups. If only one or two stocks in a group reports big earnings surprise and growth, it usually doesn’t mean much for the industry. Those stocks might present good short-term trading opportunities, but nothing more. If I notice good portion of stocks within a industry to surprisingly start beating earnings estimates and to reveal impressive growth, I pay attention to that industry. A new powerful trend might be in its beginning stages.

Today I am looking at the Airlines’ industries. Nothing fastinating is happenning there, but the recent weakness in oil and comming earnings’ reports might fuel some gigantic moves. Certainly, this is only speculation and price action will dictate my moves.