What is included in Ivanhoff Trades?

You get access to my private Twitter feed @IvanhoffTrades, where I share trade ideas and market commentary. You will receive my weekly email with practical market observations, trade ideas, and the Momentum 40 list.

You will get swing trade ideas that last 1-10 trading days. Position trade ideas that last 4-10 weeks and some intraday ideas for those who are nimble.

The goal of the service is to be fast, light, mobile, and easy to follow so the majority of it will happen on Twitter and via email. I will share options and stock swing trade ideas and my analysis of the current market. You are welcome to ask questions and discuss them on our Twitter stream.

Learn more at ivanhoff.com

Can I see your performance?

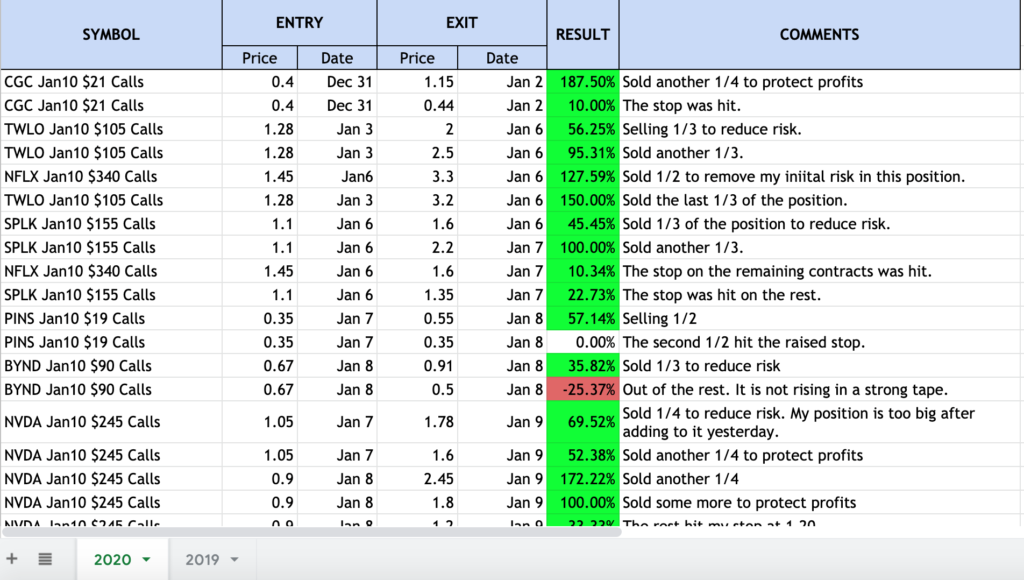

Yes, all my closed ideas are open to the public.

How many ideas do you share?

It depends on the stock market, but we tend to have at least one new idea every week. On some days, we have 3-4 new ideas. The purpose of trading is to be selectively active. Not every day or week offers the same opportunities. It’s important to know when to be aggressive and when to mostly observe.

What type of options ideas do you highlight?

There are many ways to use options but for now, we focus on simple calls and puts and we are typically buyers of premium. The goal is to capture a sizable move that is multiple times bigger than our initial risk. If you don’t feel comfortable with options yet, you can use the underlying stock for any of the options ideas mentioned here.

For short-term swing trades, we use slightly out-of-the-money options (delta 50-30) with 2 to 9 days until expiration. For example, if I like a long setup in a stock trading near 180, I might buy this or next week’s 182.50, 185 or 190 calls.

For position trades that are longer-term in their nature, we use out-of-the-money options (delta 40-20) with one to three months until expiration. For example, if I like a position setup in stock trading near $80, I might buy $90 call options that expire 4 to 10 weeks from now.

Are options suitable for me?

Options are risky and speculative. They involve leverage and they are not suitable for everyone. You need to have a high-risk tolerance. The number one rule with all options ideas I share here is that we assume that we risk the entire premium. Stop losses don’t work with many options because the market is often not liquid enough. This means that the main way to manage risk is via position sizing and proper timing. As a general rule of thumb, no one should be risking more than 2-3% of their capital on any given option idea and that’s on the heavy side. My risk varies from 0.5% to 3% of capital.

How do I get notified when you post a new idea?

You can get push notifications/messages on your phone every time I tweet or get an email with my after-hours trade ideas.

How can I follow your private Twitter stream @IvanhoffTrades?

Step 1: Subscribe to my premium service at https://ivanhoff.com/premium/

Step 2: Request to follow at twitter.com/IvanhoffTrades

What’s swing trading and is it for me?

The purpose of swing trading is to compound our returns quickly by capturing hundreds of 5% to 20% short-term moves in a year while keeping our drawdown small.

When we apply an options filter on top of swing trading, its purpose becomes trying to capture hundreds of 100%-500% short-term gains while risking 1% to 2% of our capital on every single one of them.

Read more about the difference between swing and position trading.

What stop do you use for your trades?

For swing trades with stocks, the stop is usually 3-4%.

For simple CALL and PUT options, the risk is often between 50% and 100% of the premium.

What’s the minimum capital I need to use your service?

It depends on the number and the type of ideas you wish to follow. If you want to follow every single idea and exit I share, it is preferable to have above 25k. If you want to be more selective, the capital can be smaller.

Is it possible to follow your ideas if I have an 8-5 job?

While I share a good number of new swing trade ideas during regular market hours, I also tweet and email ideas after the market close and at the weekend, which are easy to follow by anyone with an 8-5 job who cannot check on their account multiple times a day. I suggest using a buy-stop limit order which can be automatically executed even if you are not logged in to your account. I also share one or two new position trade ideas (mostly options) that typically last 4-10 weeks. They are easier to follow.

Is there an interaction between you and your subscribers?

Yes, I try to reply to everyone in a timely fashion on my private twitter stream.

Do I need to know options or swing trading before I join your service?

Having a rudimentary knowledge would be helpful but you can also learn the basics once you start the service. Remember that the purpose of this service is to be a practical learning experience, not just blindly following ideas.

Does your service focus on long-only stocks or do you adjust (go short or buy puts) if the market changes?

Of course, I adjust. I have no issues buying Puts or shorting stocks when the market is weak or there are good risk/reward opportunities.

What is the Momentum 40 list and how to use it?

Every single week, the Momentum 40 list highlights 40 of the current market leaders – high-growth stocks with powerful technical setups that are close to breaking out. The Momentum 40 list is an excellent idea-generation tool for long-term trend followers, position traders, and short-term swing traders. Many of our members use the Momentum 40 list as a starting point for their research, which saves them a lot of time and provides great ideas.