All charts in this post are powered by MarketSmith

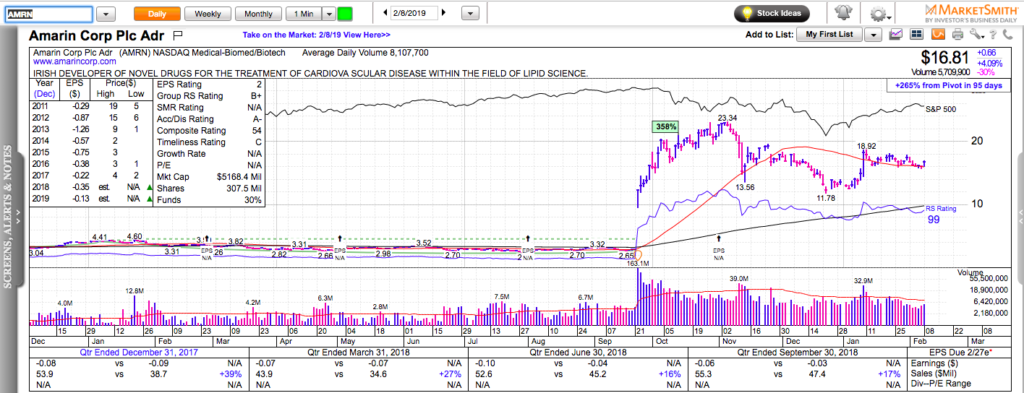

December retail sales came at -1.2%, which is the worst drop in nine years. The market didn’t care much. Dip buyers stepped up and bought the dip in many

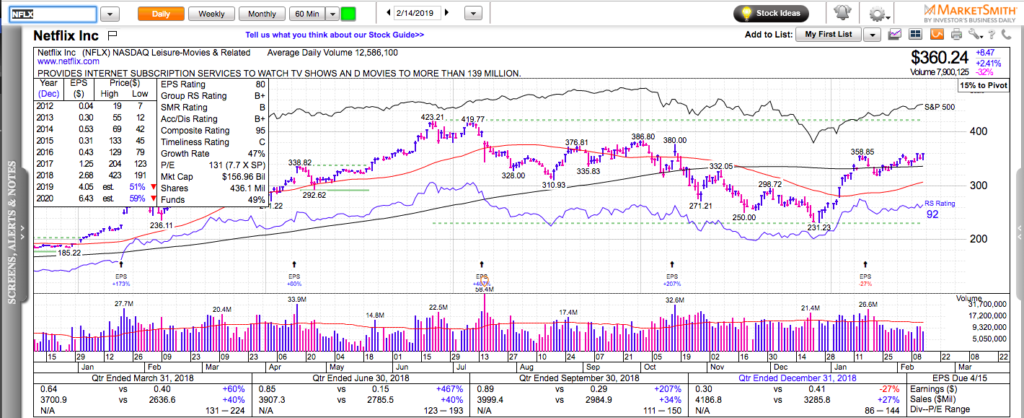

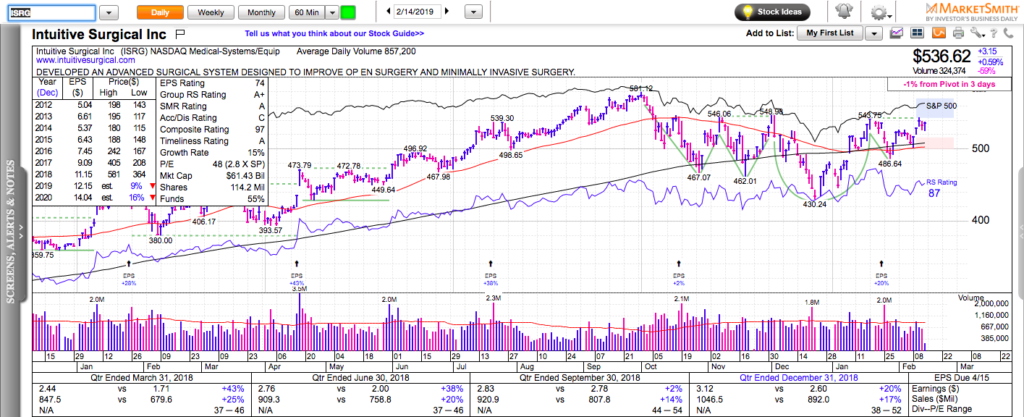

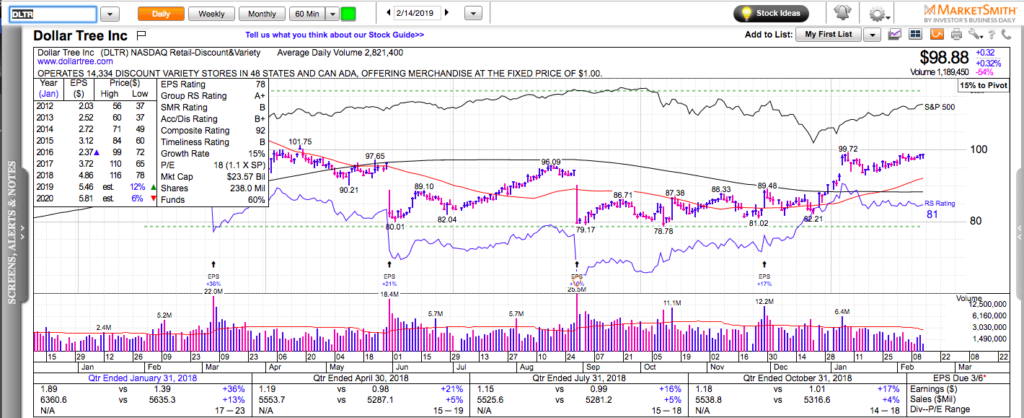

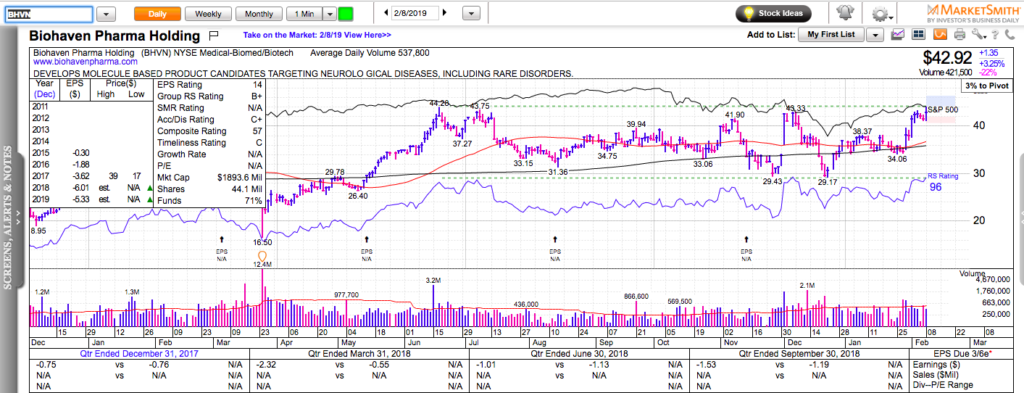

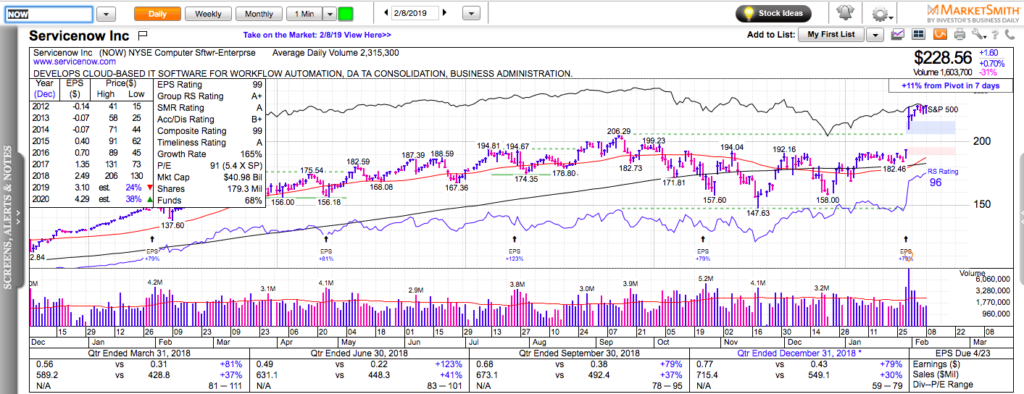

Here are three stocks in a tight range contraction, which might lead to a breakout and another leg higher:

Check out my latest book: Swing Trading with Options – How to trade big trends for big returns.