All charts on Momentum Monday are powered by MarketSmith

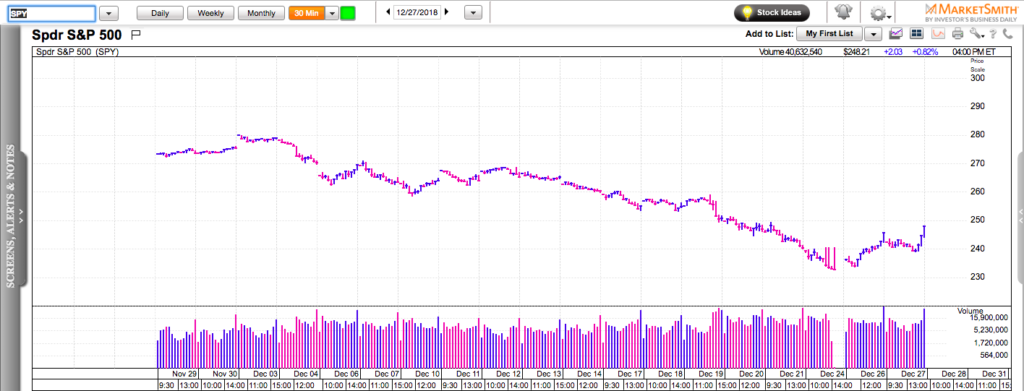

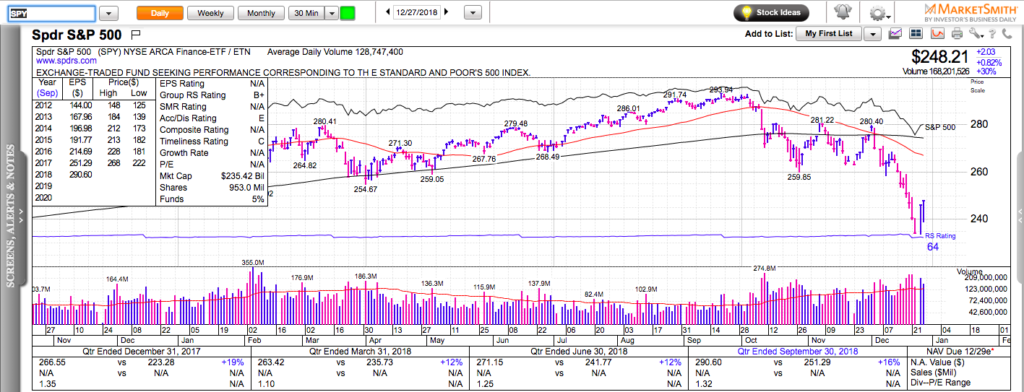

When SPY broke below its 260-280 box two weeks ago, it entered into a downward spiral and quickly dropped to the low 230s. Few were prepared for a 10% fall in seven trading days. The oversold bounce came a bit later than expected by most but it was a powerful one. Those who bought the extreme weakness too early, are very motivated to sell when their break-even levels are reached. This is why bear markets characterize with monster rallies followed by powerful reversals.

What’s next?

SPY has most likely entered into another box and we will see range-bound trading in the next few weeks. That range could be 240 to 260, or 230 to 250. The smartest way to approach the new box is to play the ranges and stay away from breakouts and breakdowns because most of them are likely to fail on longer time frames.

In the last Momentum Monday for 2018, we covered enterprise software stocks like OKTA, TEAM, and WDAY; the coming competition between DIS and NFLX; the price action in SPY, AAPL, and others.

Happy New Year!

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.