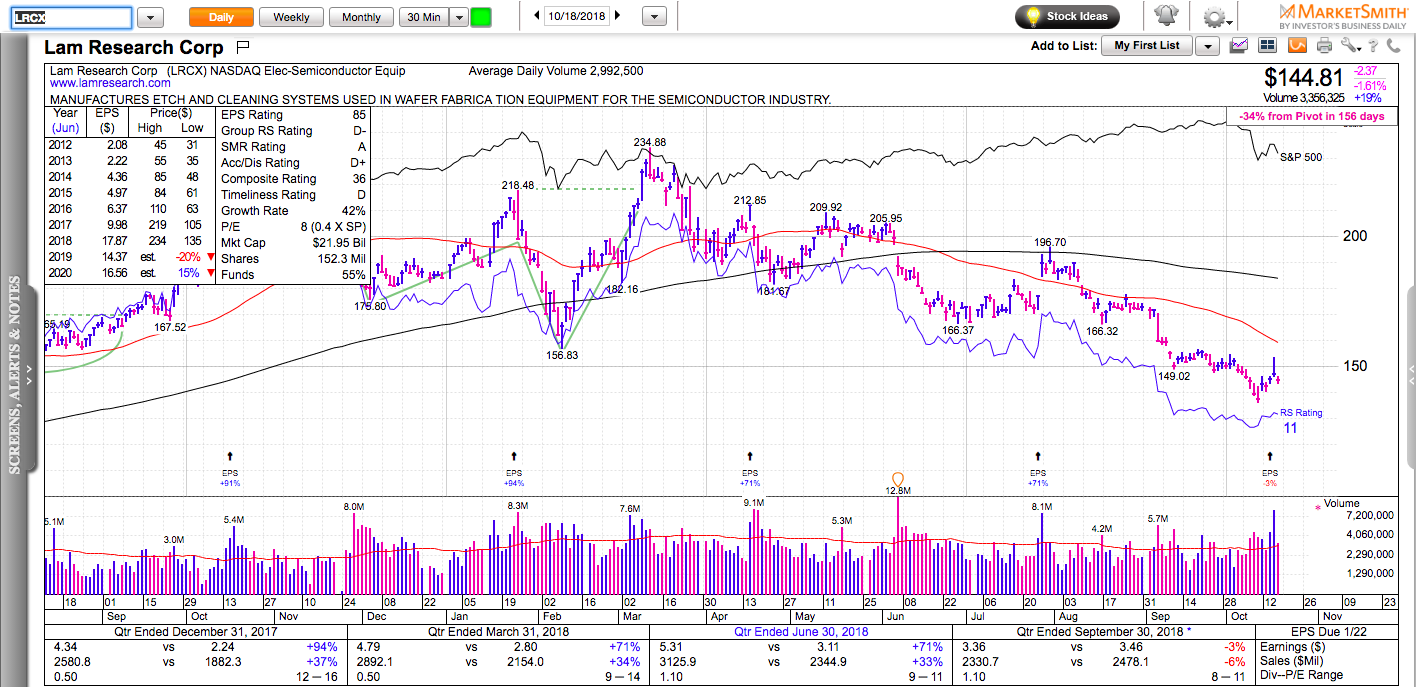

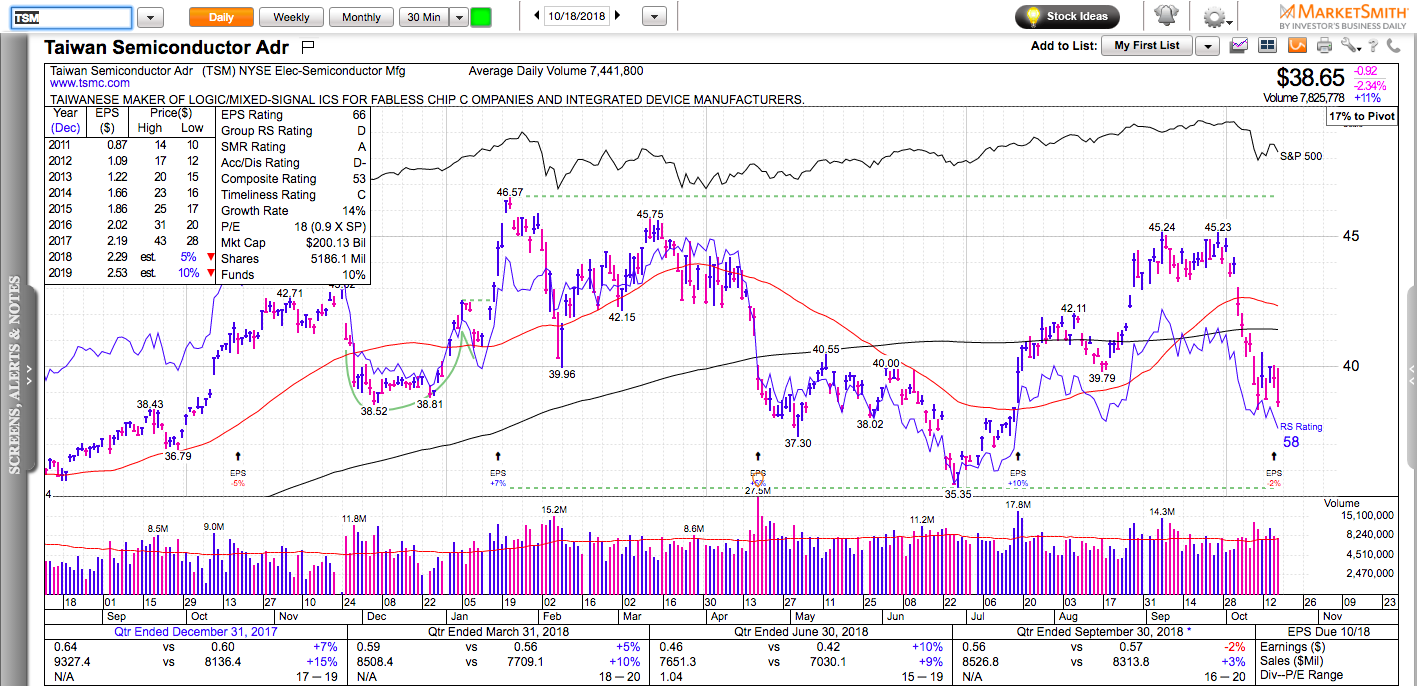

All charts in this post are powered by MarketSmith

While everyone is waiting for a test of the momentum lows achieved last week, I am paying attention to how the market is reacting to strong earnings reports because there is no better indicator of current market sentiment and risk appetite.

There are few things more bearish than a poor reaction to a strong earnings report. The earnings season is still young but this is exactly what we have been seeing lately.

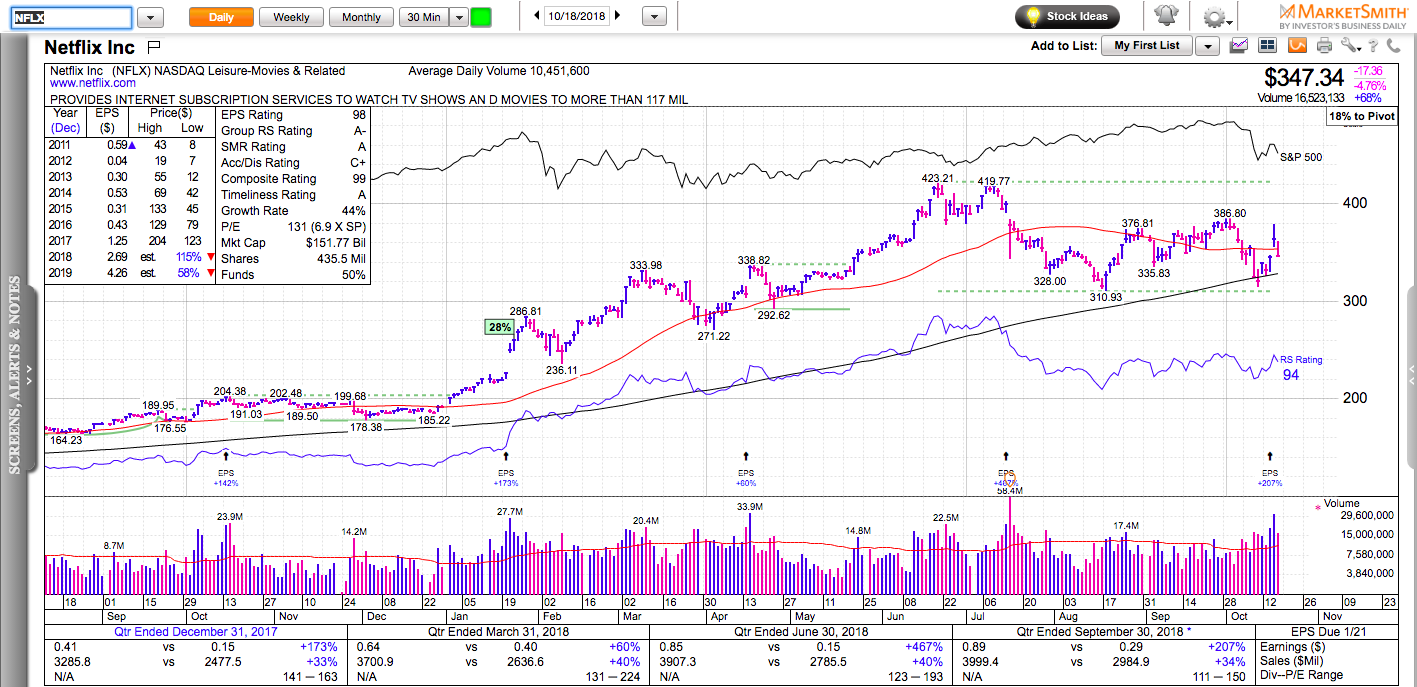

Netflix absolutely crushed earnings expectations. It reported numbers 30% above the estimates. In a strong market, such a report would lead to a gap to new all-time highs and an immediate follow-through. Instead, NFLX gapped up 10% and then it gave back its entire gap.

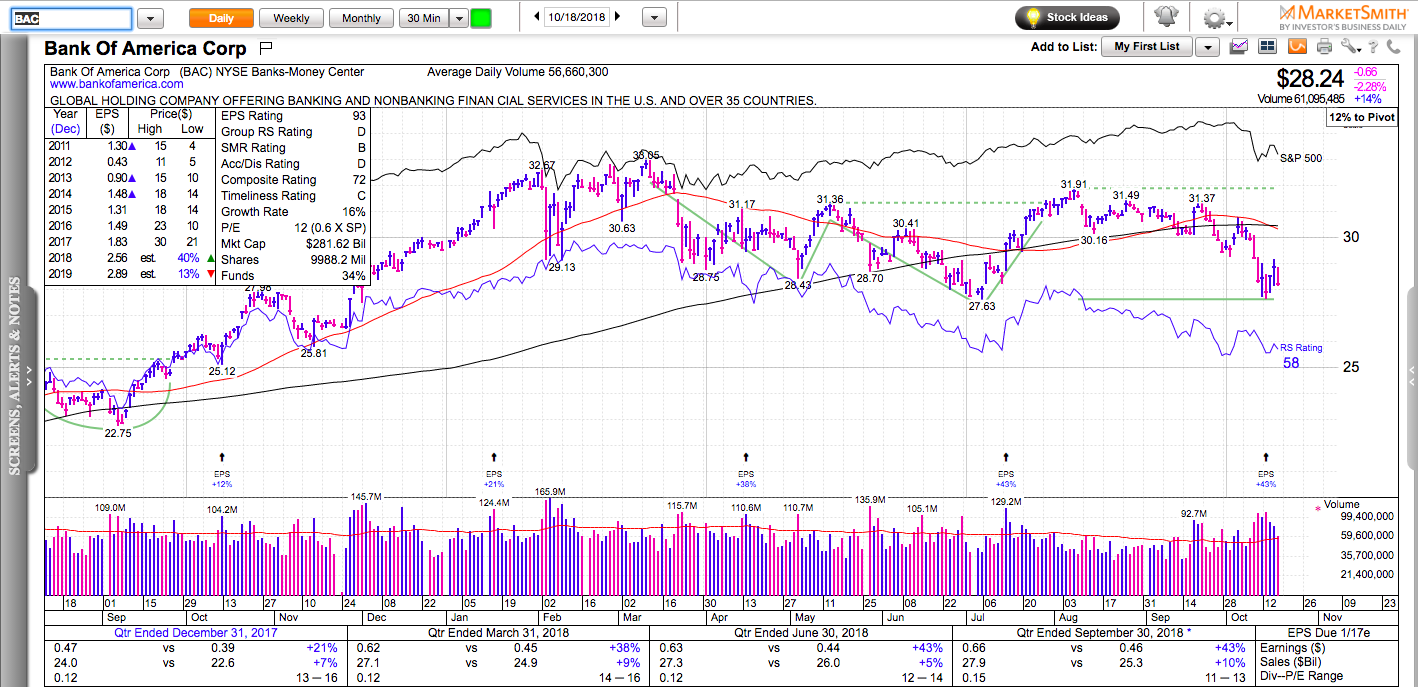

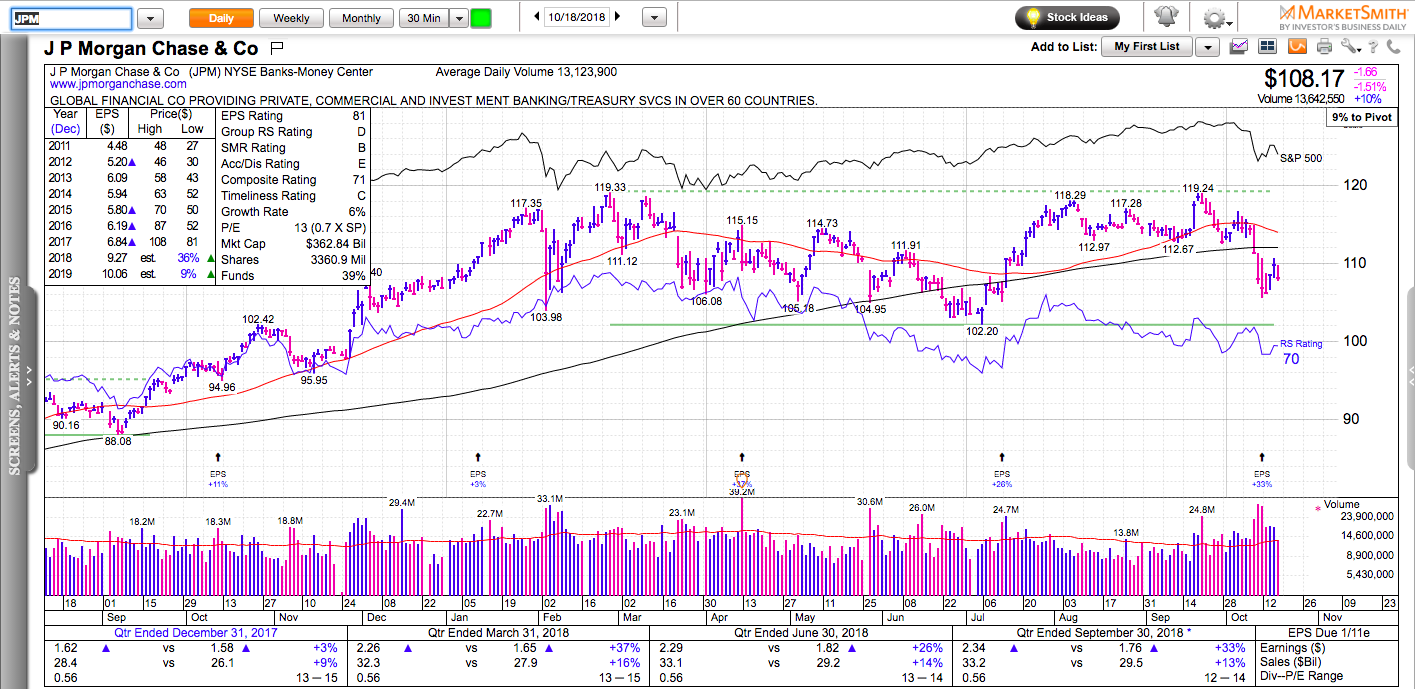

Banks are supposed to “print money” in a rising interest rate environment. Looking at their latest earnings report, they are doing exceptionally well. What’s has not been exceptional is the market reaction to their reports. Bank of America, JP Morgan, and City are all trading near multi-week lows.

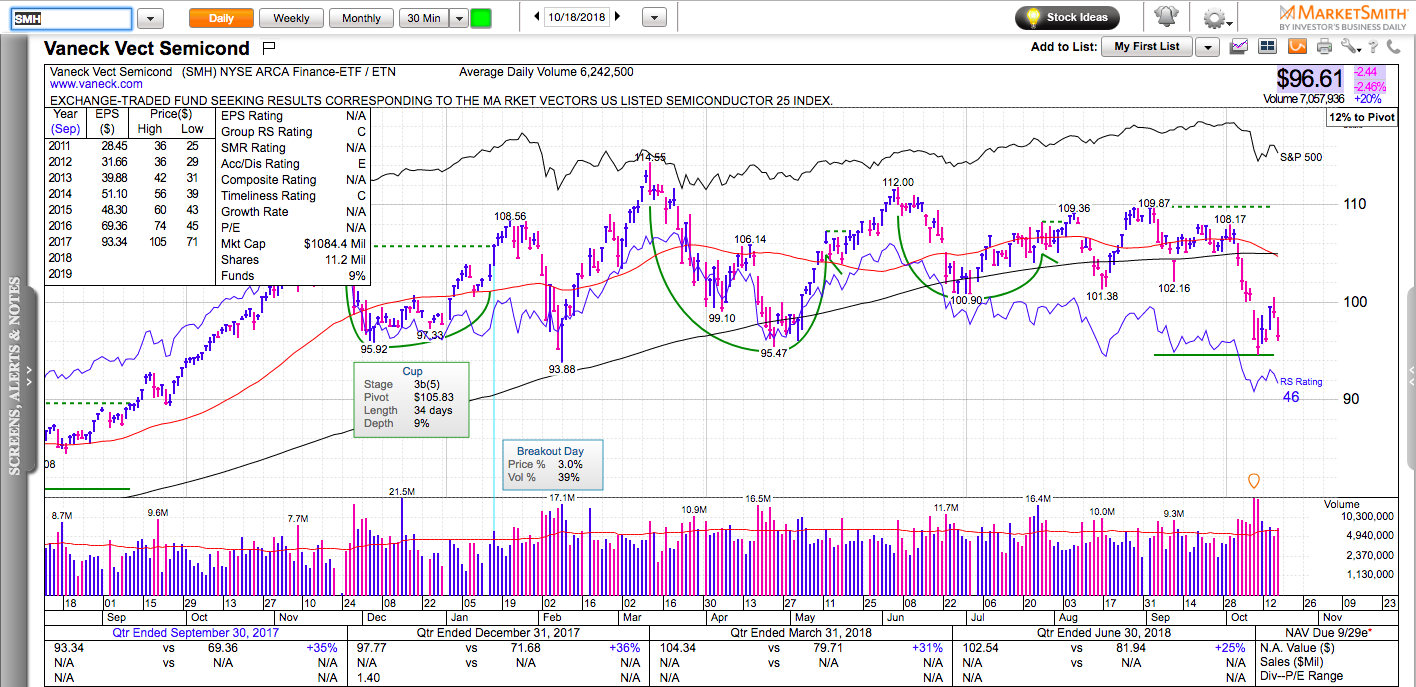

The semiconductor sector is considered “the modern dr. Copper” – the ultimate indicator of the new economy’s health. Three major semiconductor companies reported earnings in the past several days: LCRX, AMSL, and TSM. All of them beat analysts’ estimates, and yet all of them are trading lower.

Testing the indexes’ lows from last week with some form of momentum divergence (fewer stocks making new lows), can lead to a bounce, but without new strong leaders breaking out to new highs this bounce is not likely to be sustained for long. New leaders often start their rise with a high-volume earnings gap.

Maybe, the midterm elections will play an important pivotal role for a potential change in sentiment.

Don’t forget to check out my latest book: Swing Trading with Options – How to trade big trends for big returns.