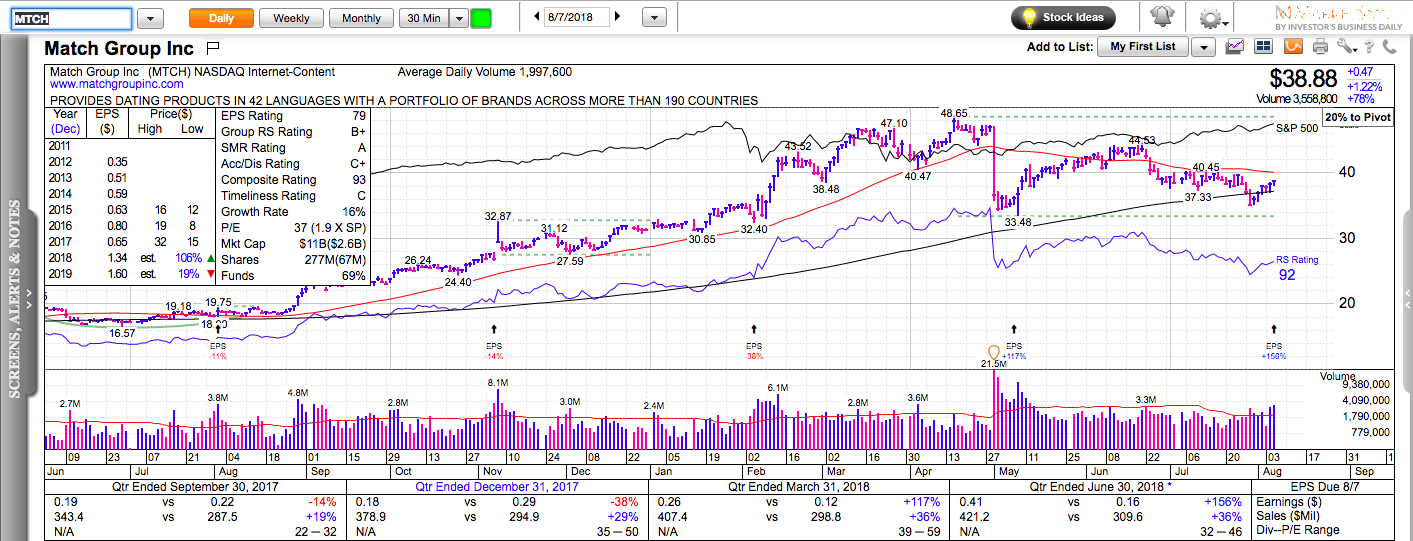

All charts in this post are powered by MarketSmith

Match Group, which owns Tinder and various other dating applications crushed earnings estimates again and it is trading near $44 per share in the after-hours session. They reported earnings per share of $0.41 vs $0.16 for the same quarter last year. Analysts expected $0.35. The surprise is not huge but it might be enough to fuel some upside momentum tomorrow.

Keep in mind that 50% of MTCH’s 62 million shares float is short. The short sellers are backed against the wall and they will try to fade MTCH tomorrow morning. If MTCH can stay above $45 after the market opens on Wednesday, we might see it attack its all-time highs near 48.65. Above it, there’s a potential for a monster short squeeze.

Here’s Tinder’s Chief Product Officer, Brian Norgard on the latest numbers:

The $Match numbers are out:

-Tinder average subs were 3.8MM in Q2 2018, increasing 299,000 sequentially & 1.7 million YOY

-Total Revenue grew 36% over the prior year quarter to $421MM

-Operating income was $150MM, an increase of 81% over the prior year quarterGreat work team

— Norgard (@BrianNorgard) August 7, 2018