Scott Bessent is probably the only one in the world who worked with investing legends like Jim Rogers, Jim Chanos, George Soros, and Stanley Druckenmiller in different stages of his career. He oversaw Soros’s $30-billion fortune between 2011 and 2015. Last year, he launched his own fund. Here are some of his more interesting market insights:

Short-selling is a unique and specific mindset

I went to work with Jim Chanos, who just did short selling. Jim was always trying to go against the crowd. He constantly picked things apart and looked for what the market had wrong.

One thing Jim was never great at was figuring out why it would end. He never really looked for the catalyst that would change the market’s focus. He was usually right, but what I’ve learned since is that it’s more important to be there when a mania ends, that spotting it early.

What I came away with from my time with Chanos was that you don’t have to be skeptical about everything.

There are also other problems with shorting. There’s a difference between investing or buying stocks and shorting. If you are a long/short player and one of your longs goes down 10 or 20 percent, you’ll buy more. If one of your shorts goes up 10 or 20%, you’ll get out.

On how Soros and Druckenmiller “broke” the Bank of England

The breaking of the pound was a combination of Stan Druckenmiller’s gamesmanship – Stan really understands risk and reward — and George’s ability to size trades. Make no mistake about it, shorting the pound was Stan’s idea. Soros’s contribution was pushing him to take a gigantic position.

With the pound, we realized that we could push the Bank of England up against the trading band where they had to buy an unlimited amount of pounds from us. The plan was to trade the fund’s profits and leverage up at the band’s boundary. The fund was up about 12 percent for the year at the time, so we levered the trade up to the point where if they pushed us back up against the other side of the trading band, we would lose the year’s P&L but not more.

The UK economy was already weak, so when they raised interest rates to defend the currency, the average person’s mortgage went up. They basically squeezed everyone in the UK with a mortgage. When they raised rates from 7% to 12% with the stated goal of defending the pound, we knew it was unsustainable and they were finished.

On his worst trade

Being short Internet stocks too early in 1999. Right trade, wrong time. It taught me the lesson that you can be right and lose all your money. Also, if a stock is going to zero it doesn’t matter where you short it, you’re still going to make 100% because you can short on the way down. You made just as much money shorting $100 million in Enron at $25 as you did shorting $100m at $50. it ‘s better to have more conviction and do twice as much.

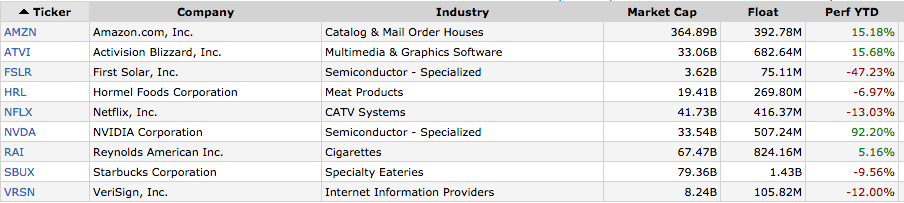

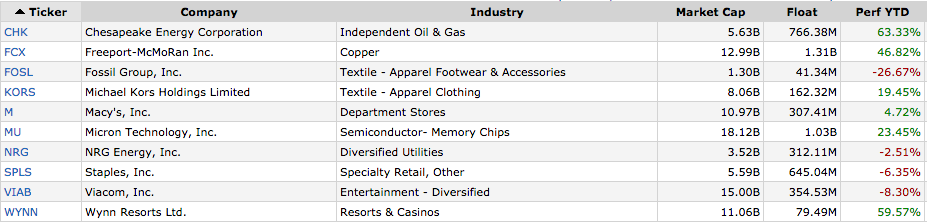

Stock Picking is full of macro bets

Recently, I was at a money manager roundtable dinner where everyone was talking about “my stock this” and “my stock that”. Their attitude was that it doesn’t matter what is going to happen in the world because their favorite stock is generating free cash flow, buying back shares, and doing XYZ. People always forget that 50% of a stock’s move in the overall market, 30% is the industry group, and then maybe 20% is the extra alpha from stock picking. And stock picking is full of macro bets. When an equity guy is playing airlines, he’s making an embedded macro call on oil.

In trading, when there’s nothing to do, the best thing to do is nothing

Soros used to give out a lot of money for other people to manage. George wasn’t bothered when people started losing money, but he was always worried that they weren’t feeling the pain properly because it was his money and not theirs. If people managing his money were down in November or December and he saw their trades getting bigger, he’d pull the money immediately. Also, if the manager was down and their trading volume picked up dramatically, he’d pull it. The worst thing you can do when you are having a hard time is flail. In trading, when there’s nothing to do, the best thing to do is nothing.

Source: Inside the House of Money, Steven Drobny