In one of the most profound speeches ever given, Warren Buffett gives an interesting and still very relevant take on diversification.

Month: March 2015

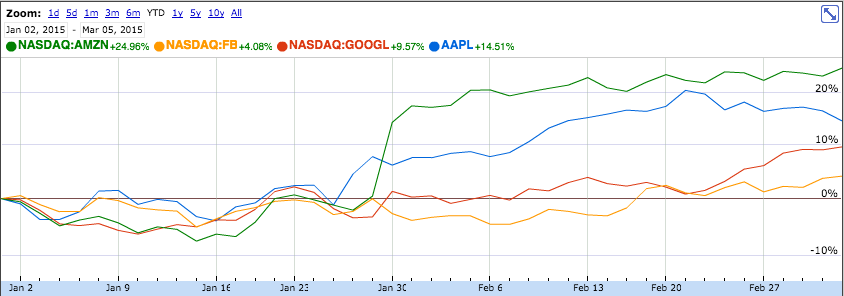

The Four Horsemen of Technology Are Crushing the Market YTD

Earlier in the year, Fred Wilson opined that Apple, Google, Amazon and Facebook might replace treasuries and gold as safe havens for investors in 2015. So far, he has been spot on. The S & P 500 is up about 2.4% YTD. After a brief jump in January, gold and long-term treasuries are about flat for the year. The worst performing tech “horseman” of the group- Facebook, is up 4%. The average year-to-date performance of the four tech horsemen is about 13%. Only the biotech sector has done better. The market is betting that the strong will get stronger.

Every trend needs skeptics and doubters; otherwise there would be no one left to buy. Not everyone believes in the bright future of those tech giants. Earlier this week, Josh Brown shared an interesting perspective from NYU Professor Scott Galloway:

The Next Big Thing

Howard Marks from Oaktree Capital has an interesting saying about bull markets and trends in general:

Very early in my career, a veteran investor told me about the three stages of a bull market:

• The first, when a few forward-looking people begin to believe things will get better;

• The second, when most investors realize improvement is actually taking place;

• The third, when everyone concludes things will get better forever

Mr. Marks doesn’t forget to point out that the third stage could continue for a very long time and deliver substantial returns to those that know how to ride trends and manage risk properly.

Even when an excess does develop, it’s important to remember that “overpriced” is incredibly different from “going down tomorrow.” Markets can be over- or underpriced and stay that way—or become more so—for years.

Sometimes, the next big thing in the stock market is the last big thing. This week’s action in biotech and semi-conductors is good example of this notion. $IBB went up 67% in 2013. Then when almost everyone thought that it had moved too much too fast, it went another 34% in 2014. So far in 2015, $IBB is up more than 14%, vastly outperforming any other sector. How long is it going to last is anyone’s guess.