When it comes to energy (and not only), I let the market (price action) does the thinking for me. It is not news for anyone that solar stocks ($TAN) have recently had a major comeback and are one of the best performing industries in 2013. They are not the only energy industry that has done well.

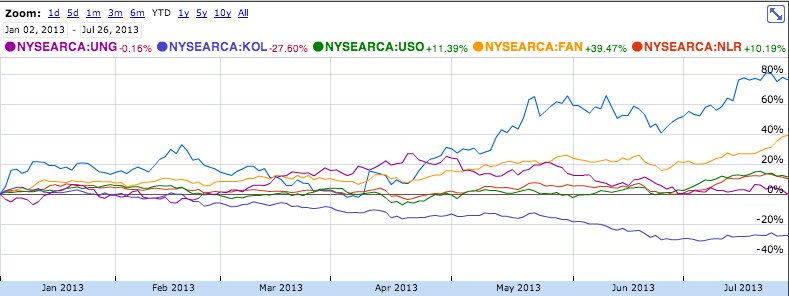

The Wind ETF $FAN is up 40% YTD and most of its gain occurred in the past three weeks.

Nuclear stocks have gone atomic this week with 100% moves in $USU and $URRE.

Despite expectations for a slowdown in the emerging markets economies, crude oil has cleared $100 and stayed there.

Coal and natural gas are the only dogs in the energy space.

I wonder what is the market trying to discount here. Typically, commodities start to outperform in the last stage of the recovery cycle, when inflation begins to rise. The latest inflation readings have been tepid, but market is usually forward-looking and discount 6 to 12 months into the future. It is not always correct, but we should always pay attention to what it is doing.