At Stocktoberfest, I had the honor to present alongside Howard Lindzon and share how I think about the stock market. There are two major cornerstones to our approach – simple is good and “a glass half full” attitude.

The most important thing to remember is that stock market is an opportunity machine. Times change, gas prices change, fashion changes, presidents change, but there are always companies that find a way to monetize on an undergoing social and business trend and make their investors rich.

One company’s rising costs are another company’s rising revenues and the market usually does a pretty good job of identifying the winners and the losers.

Albert Einstein liked to say that “Any fool can make things bigger, more complex, and more violent. It takes a touch of genius-and a lot of courage-to move in the opposite direction”. No truer words have ever been said when it comes to investing. You could make your investing life as complicated as you want it to be, but the degree of complexity is not positively correlated with market returns.

Most people put the odds against themselves as they fish for stocks in the wrong pond. Guess what? 1 out of 3 publicly traded stocks lose 75% of tgeir IPO price. All of them come from the 52-week low list.

All major stock market winners come from the 52-week high list and better yet – the all-time high list; hence we focus our equity selection efforts there.

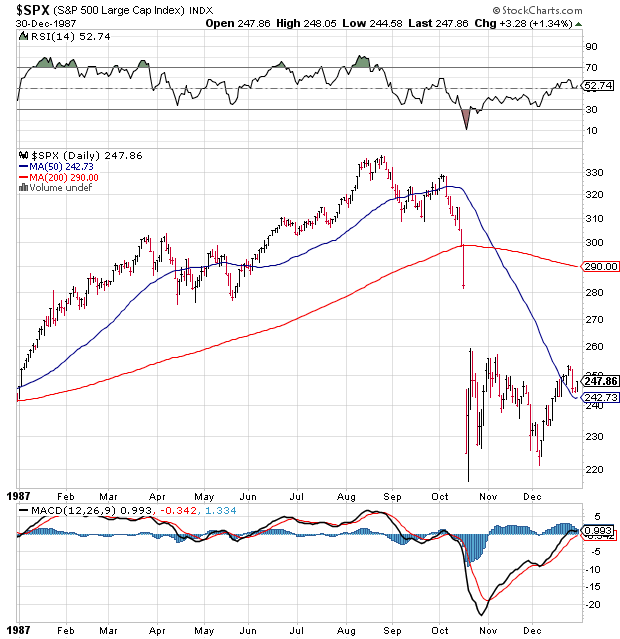

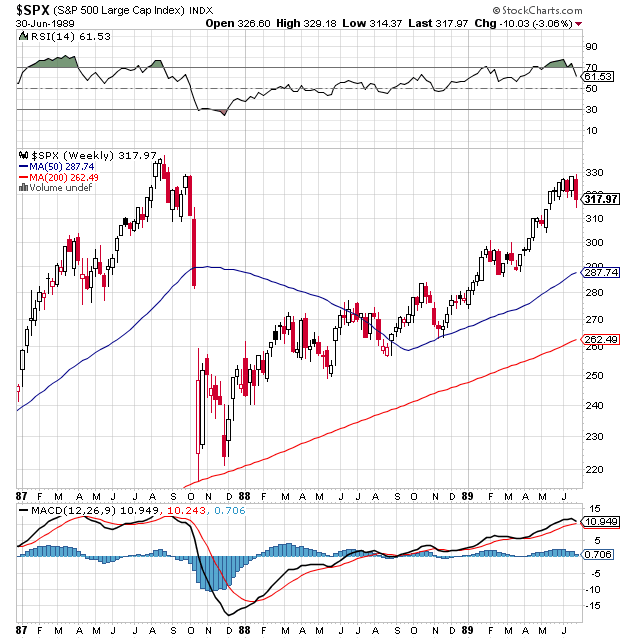

Market is a discounting mechanism that looks 6 to 12 months ahead into the future. This is why prices will often change before fundamentals change. By no means, I try to convey the message that the market is always flawless. It is not and there are short periods of time when it acts like a bipolar schizophrenic, but for the most part it is a leading indicator and I want to put the odds in my favor by paying attention to price action.

Prices don’t change when fundamentals change. Prices change when expectations and perceptions change and they could change for various reasons. From a trend follower’s perspective, the main indicator that signals change in expectations is price.

Anybody could buy a stock as the ETrade baby commercials has long tried to convince us. Most people’s investing problems come from not being able to sit on their hands when they are right. Very few hold their winners long enough to make a difference in their returns.

Price is not the only reason we buy, but price is the only reason to sell. It is good to have conviction in your picks, but discipline should always prevail. Sooner or later, all trends end and when they do, it is not pretty. I have accepted that I won’t be right every time and I have learned to live with it. Being wrong is not a choice. Staying wrong is.