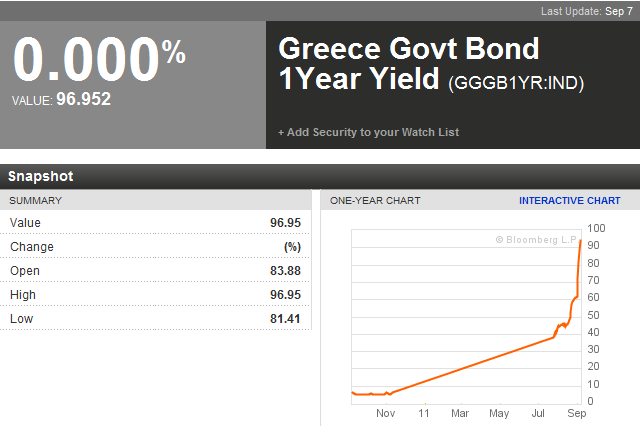

According to Bloomberg, the yield on the 1-year Greek Government Bond is 97%. With other words, the market has already priced a default, at least partial.

The fear here is that even partial default could spook investors, raise interest rates on other European nations’ sovereign debt, which might escalate to more defaults and results in under-capitalization of some of the banks that lent money. Also the worst case scenario – freezing of the credit markets.

Given the price action over the past month, you could make the case the the market has already discounted some of the scenarios mentioned above. The truth is that you can never fully discount panic; therefore we need to be ready for anything. (if this is even possible)

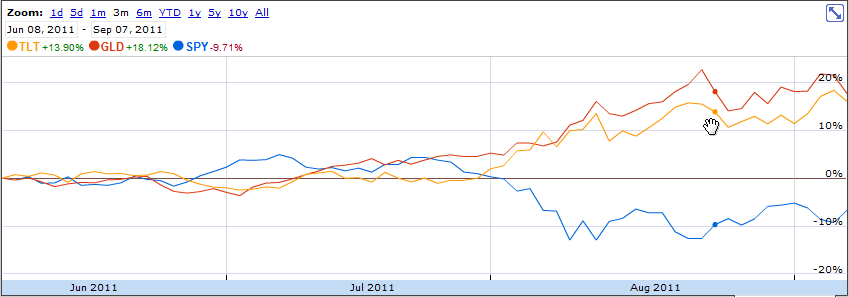

The negative correlation between equities and safety assets ($TLT and $GLD) continues to be very high – something typical for market downtrends. With that in mind, there is an increasing number of long setups.

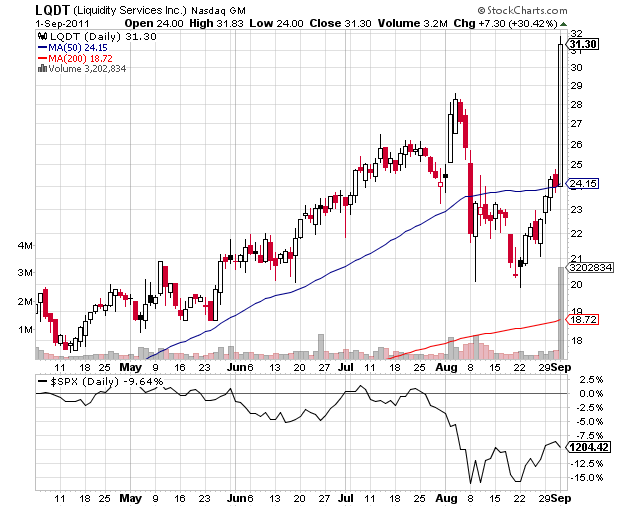

Today, more than a quarter of the liquid stocks went up 5% or more. The number of stocks near their 52 week high has been gradually increasing. Even in August, when the market averages slumped to the tune of 6% or more, there were a few stocks that appreciated 20-30%. With one leg out the door, I am willing to give a shot to some of the long setups I mentioned on my StockTwits page. I don’t have any illusions in regards to knowing where the market will go over the next few weeks. If I am proven wrong, I will be stopped out. I am well aware of the dangers of confirmation bias. If you are looking long enough for long setups, you will find them in any market.

Keep in mind that managing risk does not only involve using stops and proper position sizing, but also timing your exposure to the market. Now it is certainly not the time to go all in and be overly agressive.