For many, there is a difference between how you think you will act in certain conditions and how you actually act when the time comes. The term used to describe this condition is called empathy gap.

There are two basic scenarios in which empathy gap can impact your performance as a trader/investor:

– you don’t cut your losses when they hit your pre-established exit level. This is the single biggest reason, so many people struggle in the capital markets. One solution to the issue is to enter exit orders, immediately after you initiate an opening order (caution: it does not work with illiquid names, where market makers can easily shake you out);

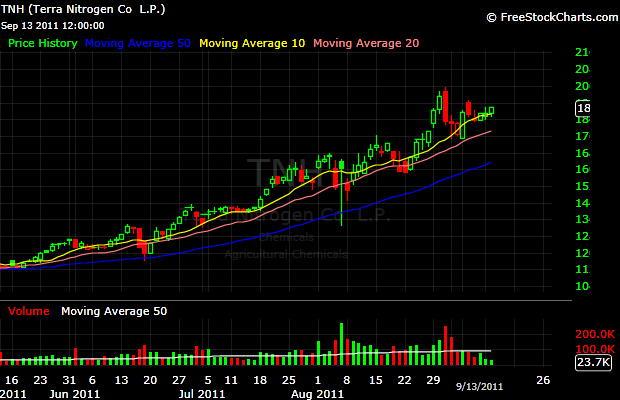

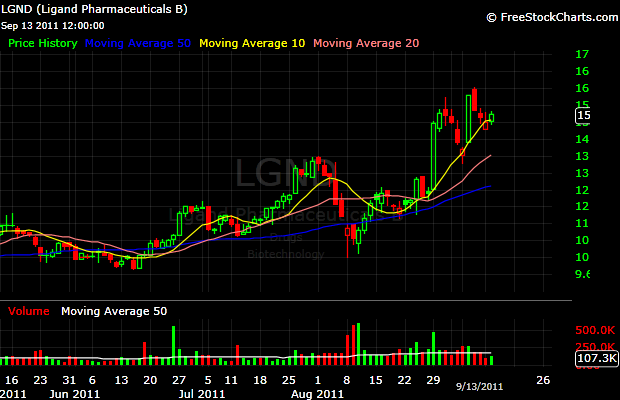

– you don’t take the signals from your watchlist when they are triggered. Some stocks can really move fast after they pass their tipping point. When that happens, many traders feel like a deer in headlights and are not willing to pay the market price. They’ll put a limit order, hoping that the desired stock will come back and their order will be filled. The best stocks don’t come back. Don’t be afraid to pay the market price for proper breakouts.

In his latest post, Steve Martin reveals that:

In today’s information overloaded world, evidence suggests that 95 per cent of our decisions are made without rational thought. So consciously asking people how they will behave unconsciously is at best naïve and, at worst, can be disastrous for a business.

This is one of the reasons why I think that survey based sentiment measures have little value. Market sentiment is reflective. It mirrors short-term price action and recent performance. For example, people who have had a number of consecutive successful long trades are likely to be much more optimistic about the markets in general than people who have been on the sidelines.

I realize that there are some hedge funds that claim that sentiment could be a leading indicator, but I have a feeling that in their case they are confusing correlation with causation. The truth is that price and sentiment live in a systemic relationship, meaning that they mutually impact each other in real time. Price changes when perceptions of risk change, but also perceptions of risk change when price changes. Since I don’t have a reliable method to catch changes in sentiment, my starting point for finding new ideas is always price.