Tomorrow marks 1 year since I joined StockTwits. Many of you don’t know that last July I emailed Howard Lindzon with an idea for a book that will leverage the knowledge and the experience of some of the best traders and investors on StockTwits. He liked it and invited me to join his team. One year later, the book is already a reality. Here is what makes it special and why you would benefit tremendously from reading it:

Tomorrow marks 1 year since I joined StockTwits. Many of you don’t know that last July I emailed Howard Lindzon with an idea for a book that will leverage the knowledge and the experience of some of the best traders and investors on StockTwits. He liked it and invited me to join his team. One year later, the book is already a reality. Here is what makes it special and why you would benefit tremendously from reading it:

1. Practical and straight to the point. Trading and Investing are about making money. We all love the timeless investment classics – Reminisces of a Stock Operator, How to Make Money in stocks, How I made $2M in the stock market, but most of them focus only on psychology. None of them actually talks about the real HOW and WHY in the details. The StockTwits Edge does.

2. Saves time. You don’t have to read all chapters to benefit from it. We don’t talk about one great trade/investment that will likely be never repeated. We teach how to find repeatable patterns and how to manage the position yourself.

3. There is something for everyone. There is not one right approach to the market. In The ST Edge, we offer over 40 market perspectives differing in style, time frame and asset class.

4. Unique structure. Most of the chapters follow a strict framework – background, market philosophy, detailed step-by-step presentation of the favorite setup, an example of an executed trade/investment where the featured principles are applied.

5. It is written by real traders and investors who put their own money at risk on a daily basis. You have seen most of them in action on the StockTwits stream. The book gives you the opportunity to gain deeper understanding of their thinking. You could actually follow up and communicate with them on the stream.

6. Very solid read. It is not something you can read in a day. It is not even something you can read in a week either and catch all the insights. How much you will get from this book is a function of your experience. Someone with three years of experience will see the presented concepts in totally different way than someone with just one year of experience.

7. It is focused on actionable setups. You don’t need to wonder any more what to look for. All steps for finding trading/investing ideas are explained clearly and succinctly. You will get an insight into what factors are actually important for the different market styles and why they are important.

8. It is one thing to know chart patterns. Knowing the psychology behind the patterns is a totally different level of understanding. We asked all contributors to explain the underlying psychology behind each step of their equity selection and risk management process, so the reader can gain better understanding.

9. Each setup is described via an example, specifying when to enter, how much to risk, where to exit and why. Straight to the point.

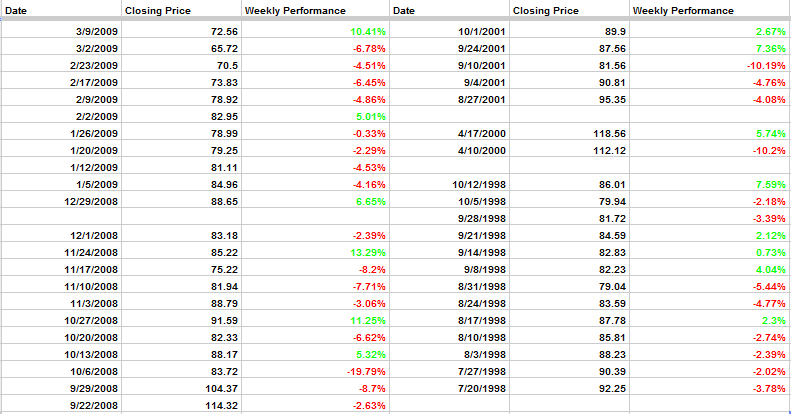

10. Huge educational value, summarizing hundreds of years of collective experience, shared in 46 chapters and over 100 charts and tables to better visualize the presented market concepts.

Naturally I am biased as I have a chapter in the book, but the truth is that I would never endorse it if I don’t believe in it.

This book is truly unique and I believe in every word I said here. I gained tremendously from my contact with more than 50 traders and learned a lot as we worked on their chapters. Now, that hard earned knowledge is neatly packed in a state of the art hard cover book for you to consume at your convenience. For me personally, The StockTwits Edge is worth its weight in gold and then some. It is a worthwhile addition to the library of any trader, who is looking to improve his/her skills and market understanding. Let’s face it. There is always something left to learn.

Don’t take my word for granted. You can judge for yourself by reading the short excerpts from the book that we post on its dedicated website: thestocktwitsedge.com

The quality of our lives is defined by the choices we make every day. I will be honest with you. I am writing all this out of respect to all the efforts that more than 50 people gave for this project to come to fruition. Your purchase is not going to change my life in no way, but it might change yours.

Enough said.

Good trading,

Ivanhoff