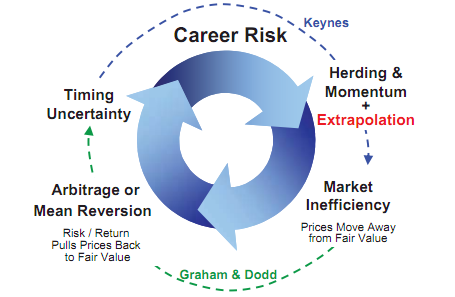

Jeremy Grantham’s latest newsletter is out and as always is well worth the read. He is a value investor, but he comprehends the inherent structure of the stock market to a level, where he clearly understands why and how the momentum phenomena works. Institutional money managers manage first and foremost their career risk and then their clients’ risk, which results in very little originality on Wall Street and essentially herding. Herding is the foundation behind momentum. There is nothing wrong to be part of the herd as long as you have well thought out, disciplined exit strategy. Herding is not uniquely human. It can be noticed in almost all living species on Earth. It is ingrained in our brains as a basic approach for survival.

Remember, when it comes to the workings of the market, Keynes really got it. Career risk drives the institutional world. Basically, everyone behaves as if their job description is “keep it.” Keynes explains perfectly how to keep your job: never, ever be wrong on your own. You can be wrong in company; that’s okay.

Keynes had it right: “A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him.” So, what you have to do is look around and see what the other guy is doing and, if you want to be successful, just beat him to the draw. Be quicker and slicker. And if everyone is looking at everybody else to see what’s going on to minimize their career risk, then we are going to have herding. We are all going to surge in one direction, and then we are all going to surge in the other direction. We are going to generate substantial momentum, which is measurable in every financial asset class, and has been so forever. Sometimes the periodicity of the momentum shifts, but it’s always there.

One thought on “Career Risk – Herding – Momentum”

Comments are closed.