On August 23rd, I wrote a post: $ASYS – the anatomy of an earnings trade, where I described the catalysts behind $ASYS move. I finished the post with the following quote:

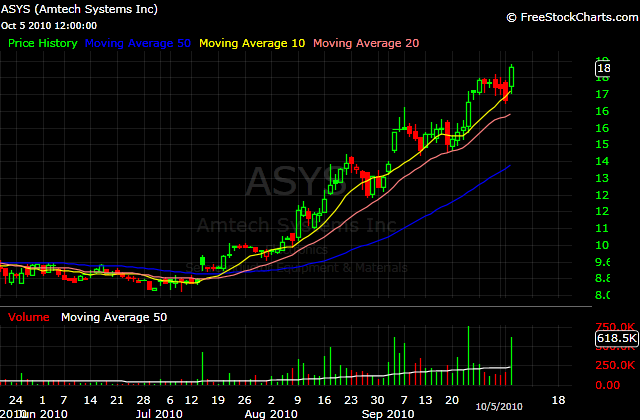

“$ASYS is currently overextended and it is likely to experience a pullback, probably to a longer time-frame MA – 20 day or 50 day. Let see if the previous zone of resistance around $12-$13 will turn into support.”

This is exactly what happened. The stock retreated to its rising 20-day MA, where it built a proper base and continued to march higher.

In my previous post, a commenter asked me to explain my approach towards position management. I utilize four very simple rules:

1) I sell 1/2 of my position if it appreciates more than 15-20% above my entry point. For the other half, I raise my stop to break even. I want to make sure that that I protect at least part of my profits. I can always add more later when the stock sets up again.

2) I sell the whole position if it increases to a level of 25% above its relevant moving average. At this point I have no idea if the stock is going to continue higher. All I know is that it is extended and based on experience, profits should be taken. Do all stocks tend to reverse after they reach 25% above their relevant MA. Absolutely not. They could go much higher. The point is that I don’t try to squeeze every cent out of a stock. I don’t have to in order to be consistently profitable.

3) I add 1/2 position on a 3% bounce from a relevant rising MA. The volume of that move has to be at least 120% of the average 50-day volume. Such price/volume action is a good indication of strong risk appetite for the stock.

4) Sell if the stock violates the low of the first day it closed below its relevant MA. The last condition is applied only if I am in a profitable position. If the stock turns against me immediately after I buy it, I make sure to keep my losses to 5 – 8%. When the average size of my winners is 2-3 times bigger than the average size of my losing trades, I can afford to be wrong 60% of the time and still make money.