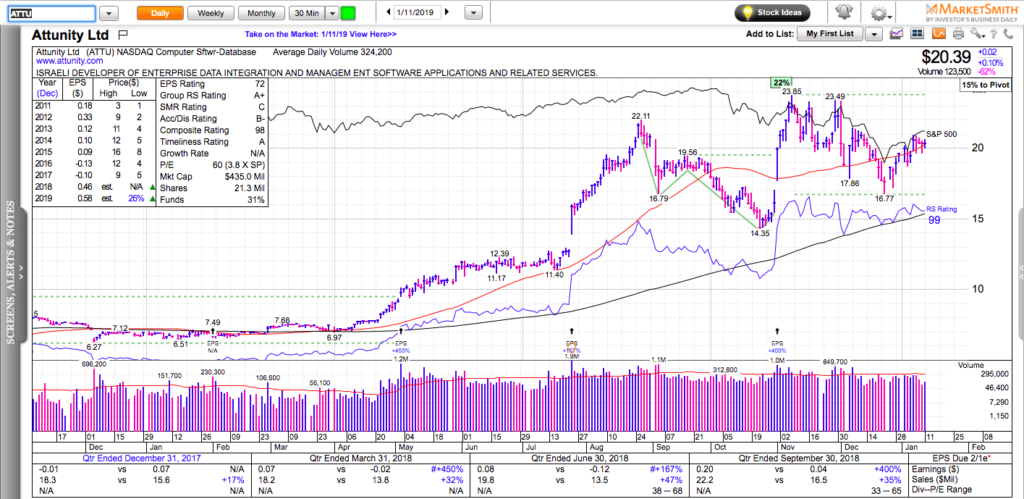

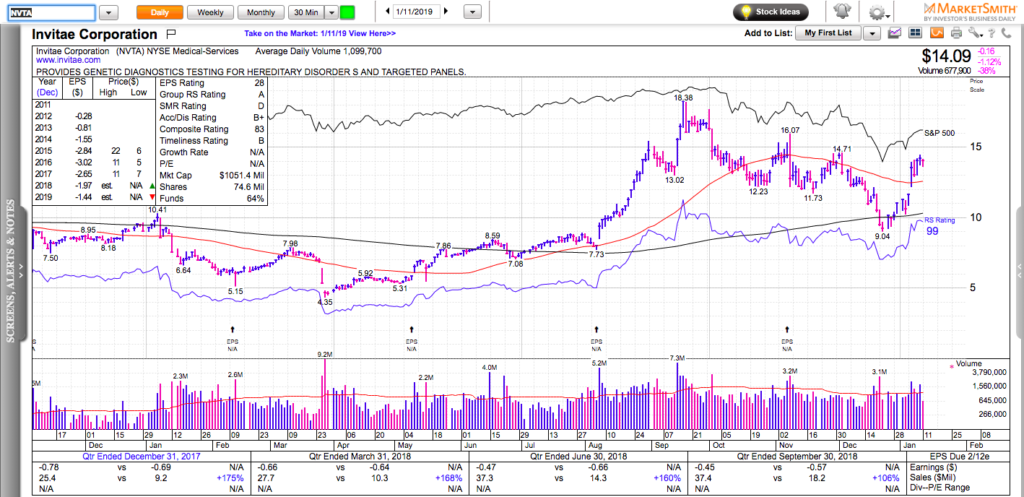

All charts on Momentum Monday are powered by MarketSmith

$260 is proving to be a tough nut to crack for SPY, which has been basing below it for the past few trading days. This is not unexpected. 260 was a major support in late 2018. It’s normal to act as short-term resistance after SPY broke below it.

So what’s next: a new leg lower or a higher low and a break above $260, which can spur a fear-of-missing-out rally? Dip buyers have been very insistent lately and bad news has not been punished harshly by the market. This is typically a sign of positive market sentiment.

On today’s Momentum Monday, we discuss LULU, NKE, enterprise software stocks, the state open-source software companies, some biotech ideas and the connection between private and public markets.

Check out my latest book: Swing Trading with Options – How to trade big trends for big profits.