“You don’t need analysts in a bull market, and you don’t want them in a bear market.” – Gerald Loeb

People like to mock sell-side analysts and point out how little value they add. Their calls are often too late, biased, and sometimes – contrarian signs.

Macy’s shares have fallen 72% since the summer of 2015, so Citi downgrades it a Sell today. Great! $M https://t.co/JGIT892MzN

— Downtown Josh Brown (@ReformedBroker) October 30, 2017

Is it really too late to downgrade a stock after it has fallen 70% in the past two years? It depends. Stocks that make new 52-week lows in a bull market are usually there for a good reason. They can often keep going lower. For reference, check in the price action in coal stocks in the past few years.

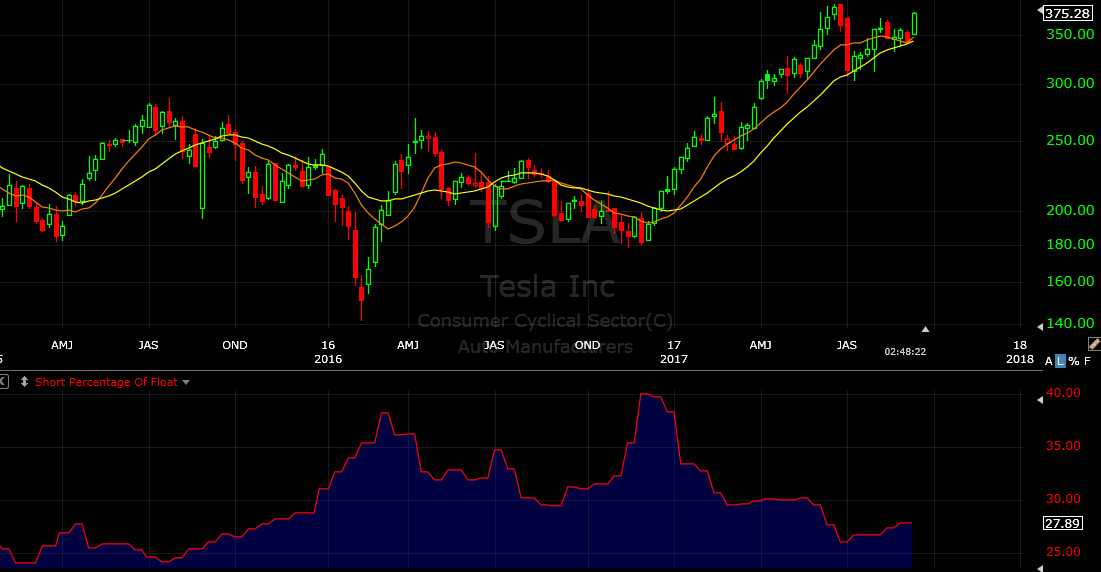

A lower stock price can actually worsen a company’s fundamentals. For many, fundamentals only involve earnings and sales growth, assets minus liabilities, current and expected cash flow. But what’s behind all those ratios and numbers? A company’s reputation, the people that work for that company, the strategy they are pursuing, the technology they are using. All of the above form a company’s competitive advantage.

A company’s stock is essentially its currency. It’s a reflection of the market’s expectations and beliefs. If a company’s stock drops substantially, it will hurt its ability to attract and attain qualified people, which in turn will impact the service and the products it provides, the partnerships it can create, its ability to acquire promising startups and their technologies, etc. A big and continuous decline in a stock price can change a company’s fundamentals; therefore issuing a downgrade after a 70% drop might not be as mindless and useless as it appears.

The same line of thoughts can be applied to companies with rising stock prices. A considerable and sustainable increase in a stock’s price can actually improve a company’s fundamentals. George Soros’s reflexivity theory at work.

P.S. My twitter account @ivanhoff has been hacked and I don’t have access to it anymore. The gmail associated with it has been deleted, so I cannot recover it. How did they get access to my gmail? They called my telecom and pretended to be me, so they managed to transfer my phone number to their sim card for a few hours. Maybe, I should write a post about how to better protect yourself. I learned a lot about it in the past week. Anyway, my new twitter handle is @ivanhoff2. On StockTwits, I am still @ivanhoff.

Also, my book Top 10 Trading Setups is a great gift for the upcoming holidays.