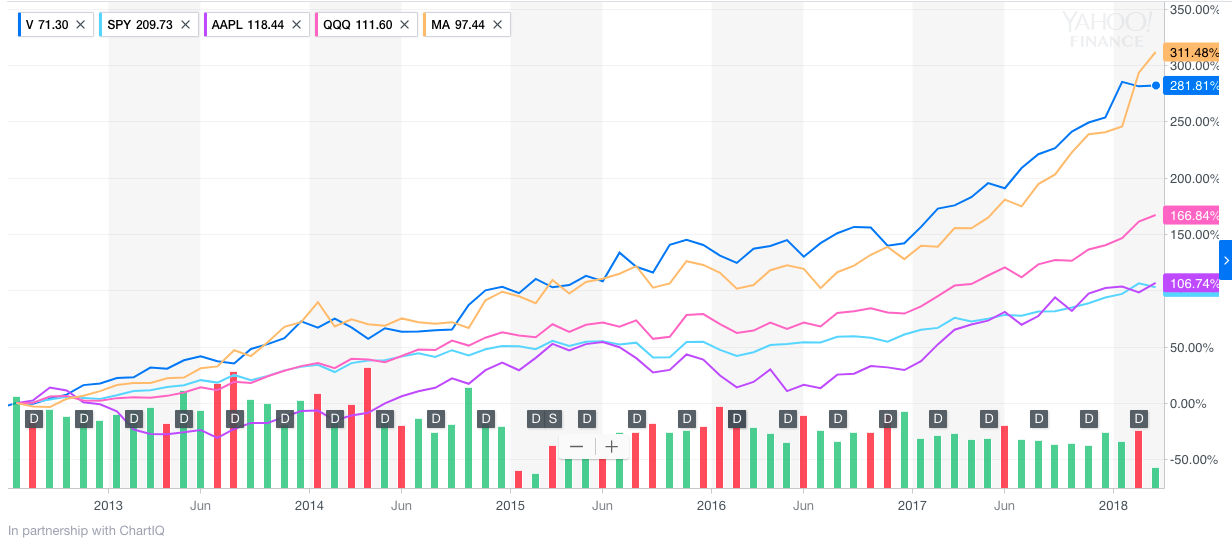

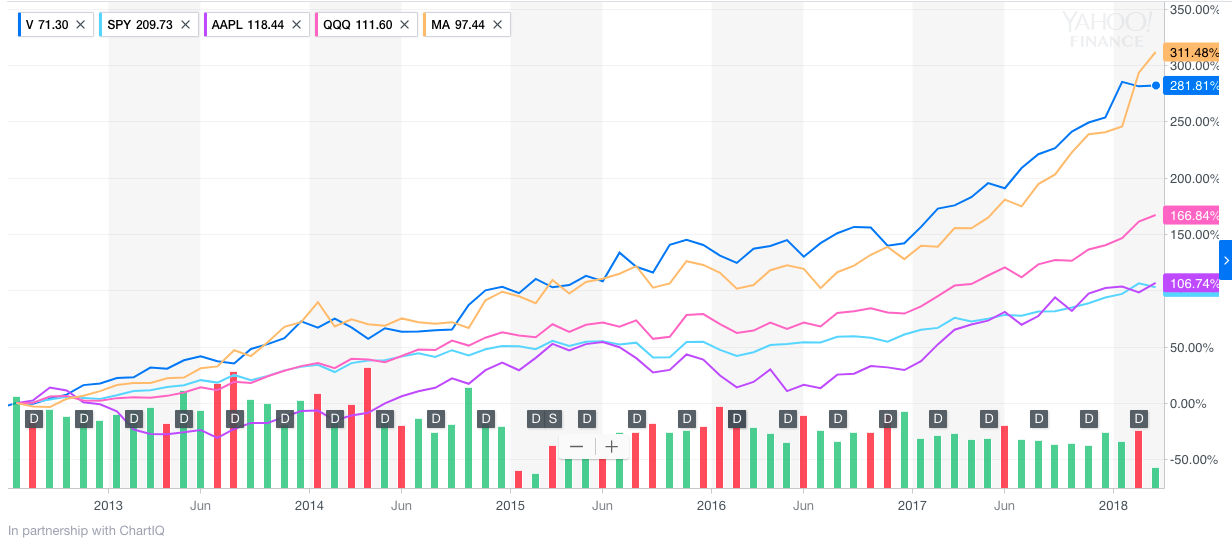

Five and a half years ago, Abnormal Returns asked a bunch of people from the financial blogosphere to share their best pick for the next decade – an asset people would feel comfortable holding. Most chose SPY. There were some calls for Nasdaq, AIG, Apple, Ford, Emerging markets. I chose Visa and/or Mastercard.

Here’s my reasoning in 2012:

“I am not a long-term investor per se.10 years is an eternity and a lot of price cycles will change over that period of time. Nevertheless, for the purposes of this exercise, I would go with Visa ($V) or Mastercard ($MA). They have so many catalysts going for them – rising online sales, digital wallets, emerging markets and are part of the S&P 500 which will likely do well too.”

Sometimes, simple and obvious things in the market work out better than you expect.

I am still bullish on Visa and Mastercard. They continue to ride the wave of massive smartphone adoption and rapidly rising online and cashless transactions around the world. But I also pay attention to the potential threats around the corner. The blockchain technology will likely create many new competitors for Visa and Mastercard. They are not going anywhere. They will continue to grow but their margins are likely to come under pressure. I think we are at least five years away from that happening.

What is to stop Apple and Google from creating a bank? Quite a few of their users would proudly transfer their finances to the Bank of Apple and the bank of Google. More and more people will use their phone as a digital wallet and pay everywhere with it. Services like Venmo will become more popular and share less personal information. All merchants will surely love a transaction that doesn’t involve paying 3% to Visa or MA.