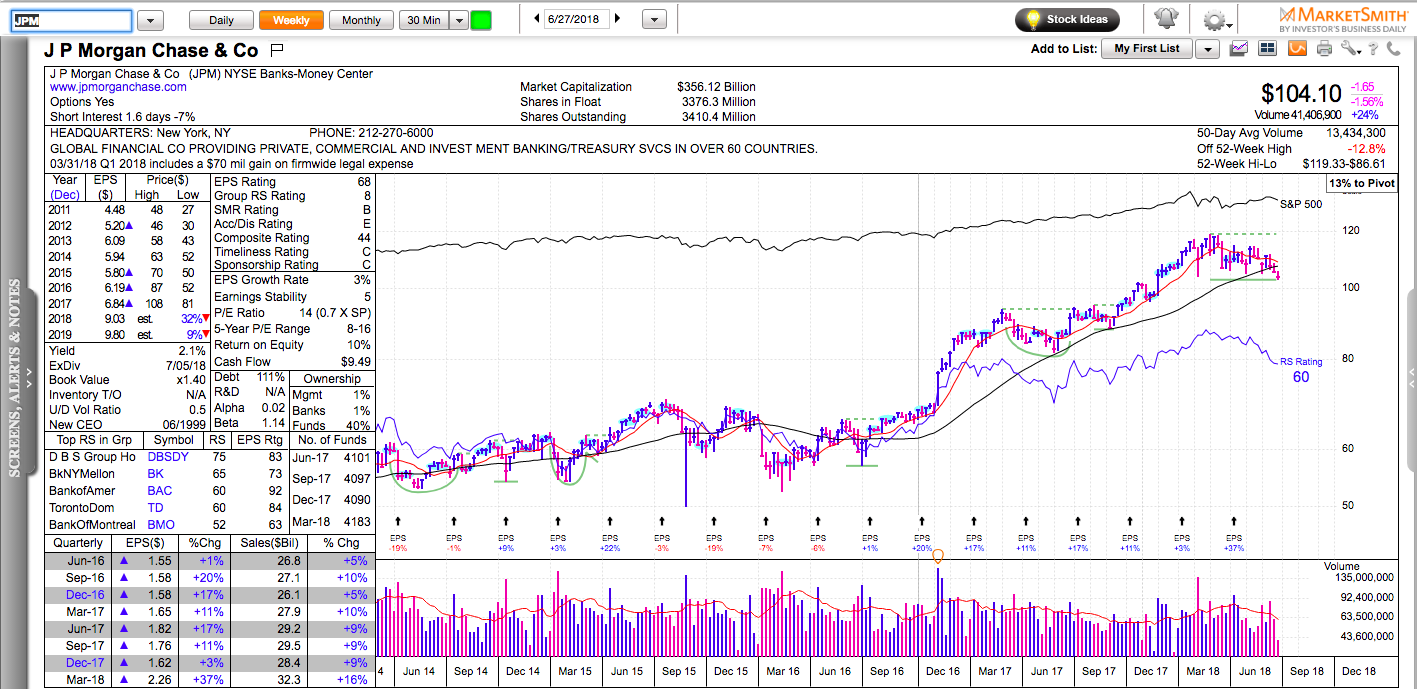

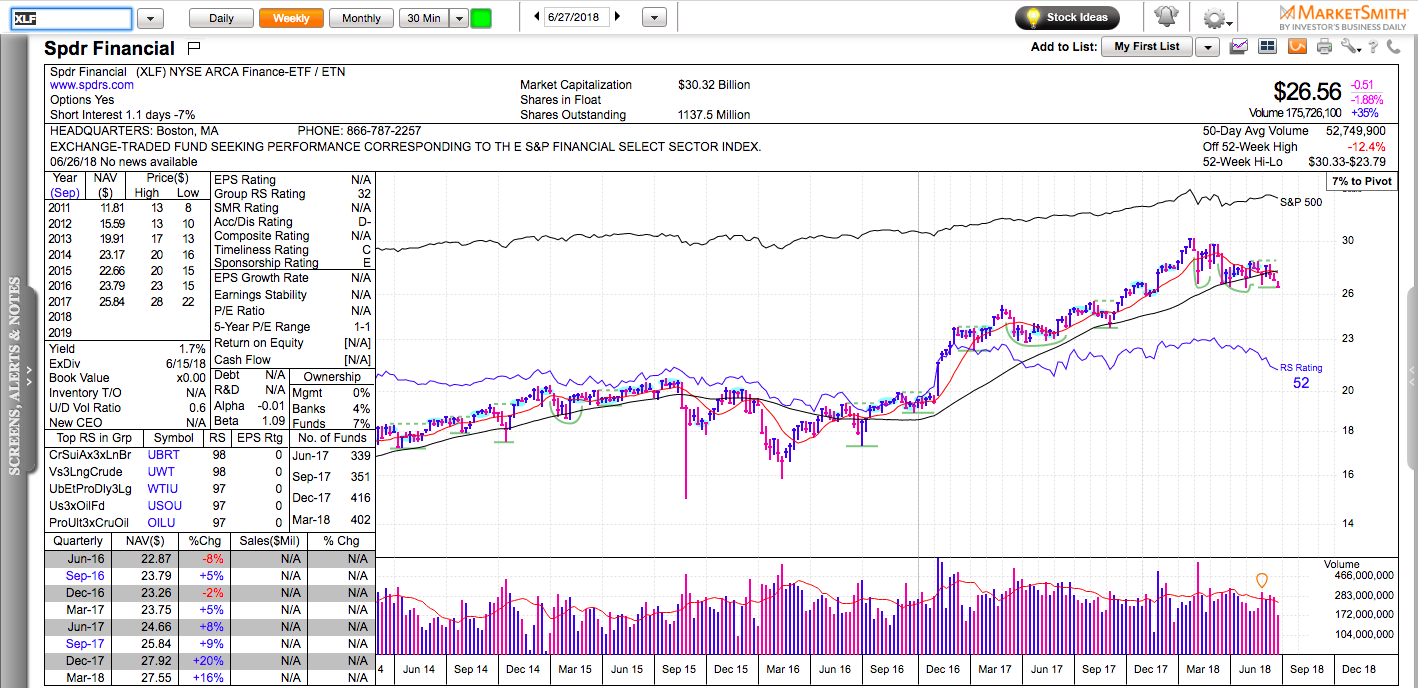

Charts in this post are powered by MarketSmith.

The market environment has certainly changed in the past couple of weeks. We went from a market, where almost all breakout led to a quick 10-30% move to a market with many failed breakouts.

Many Chinese Internet stocks are already down 10-20% from their recent highs and trading near levels of potential support. It will be interesting to see if dip buyers start to step in.

The small-cap biotech etf, XBI tried to break out a couple weeks ago, but the weakness in the general market pulled it back. Nevertheless, we are starting to see some decent long setups in the biotech space.

Some of the tickers we cover: SPY, TSLA, SBUX, XBI, SEDG, SFIX, PETQ, TRUP, etc.

Disclaimer: everything on this show is for informational and educational purposes only. The ideas presented are not recommendations to buy or sell stocks. The material presented here might not take into account your specific investment objectives. I may or I may not own some of the securities mentioned. Consult your investment advisor before acting on any of the information provided here.