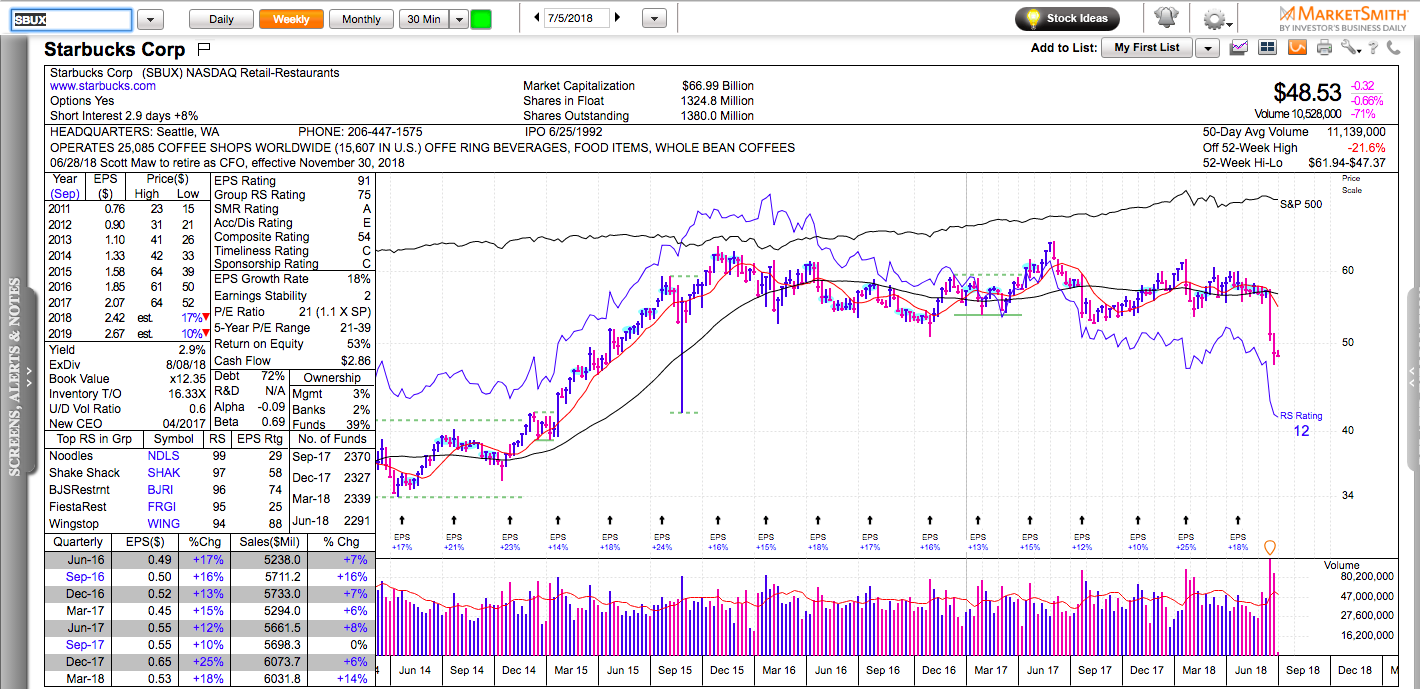

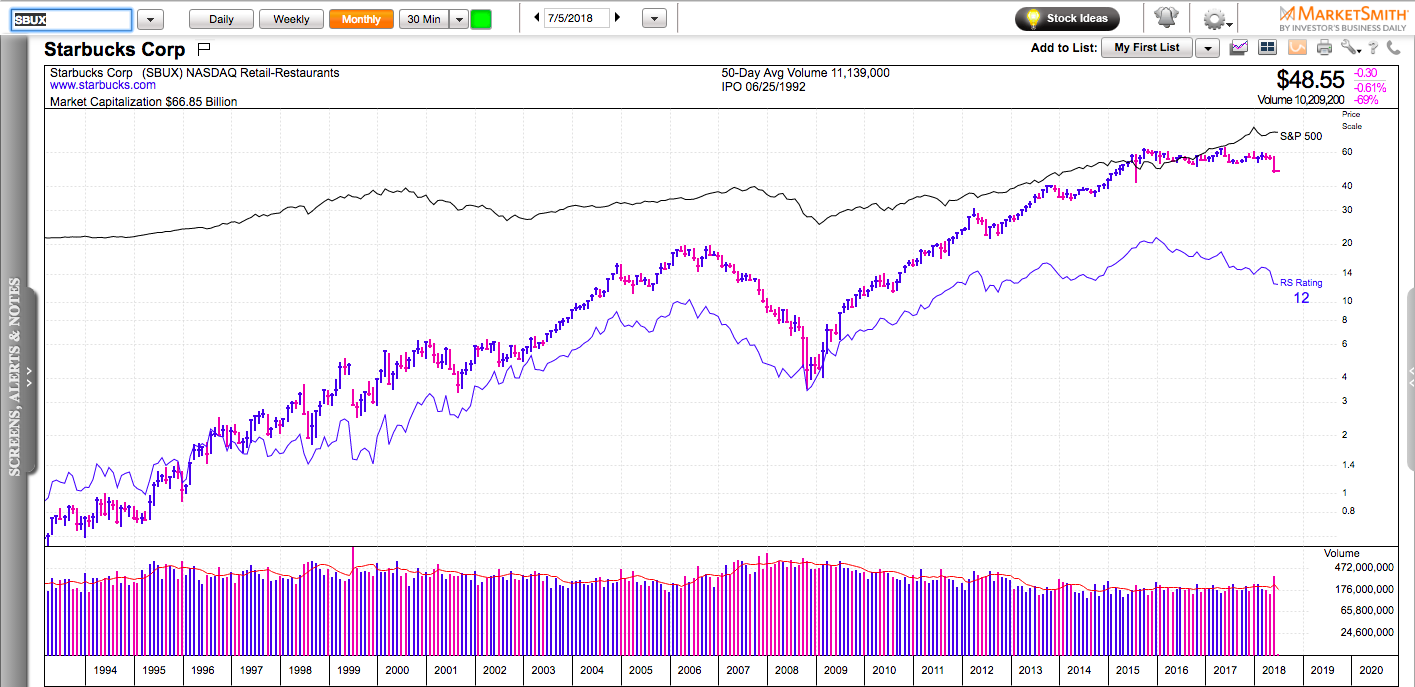

Charts in this post are powered by MarketSmith.

The Nasdaq 100 reached new all-time highs a few days before earnings season began. Amazon, Facebook, Google, and Microsoft rallied in anticipation of another set of strong earnings. Market expectations are certainly running high, so it’ll be interesting to see if the numbers justify them.

Netflix reported earnings after the close on Monday and so far, the reaction is not stellar. Netflix is down more than 10%. Reactions to earnings matter because they reflect the current market sentiment. Bad news is usually ignored in strong bull markets.

Disclaimer: everything on this show is for informational and educational purposes only. The ideas presented are not recommendations to buy or sell stocks. The material presented here might not take into account your specific investment objectives. I may or I may not own some of the securities mentioned. Consult your investment advisor before acting on any of the information provided here.