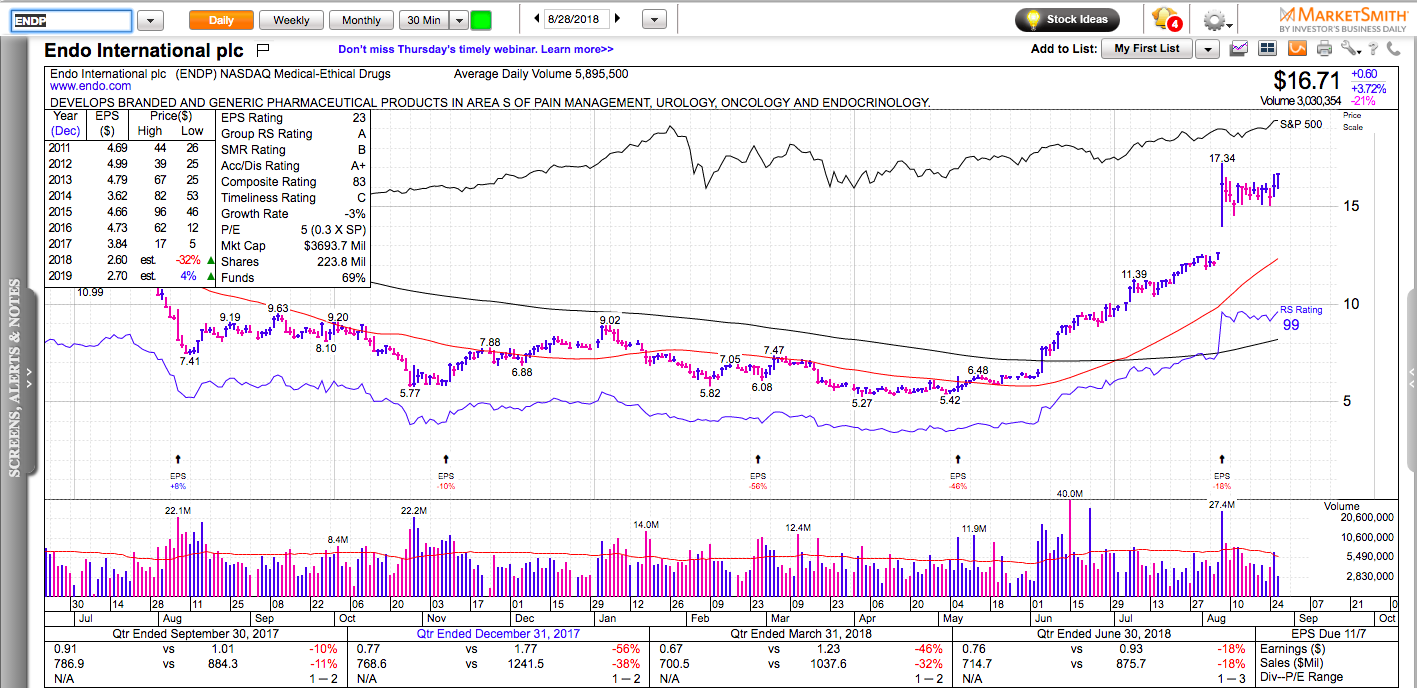

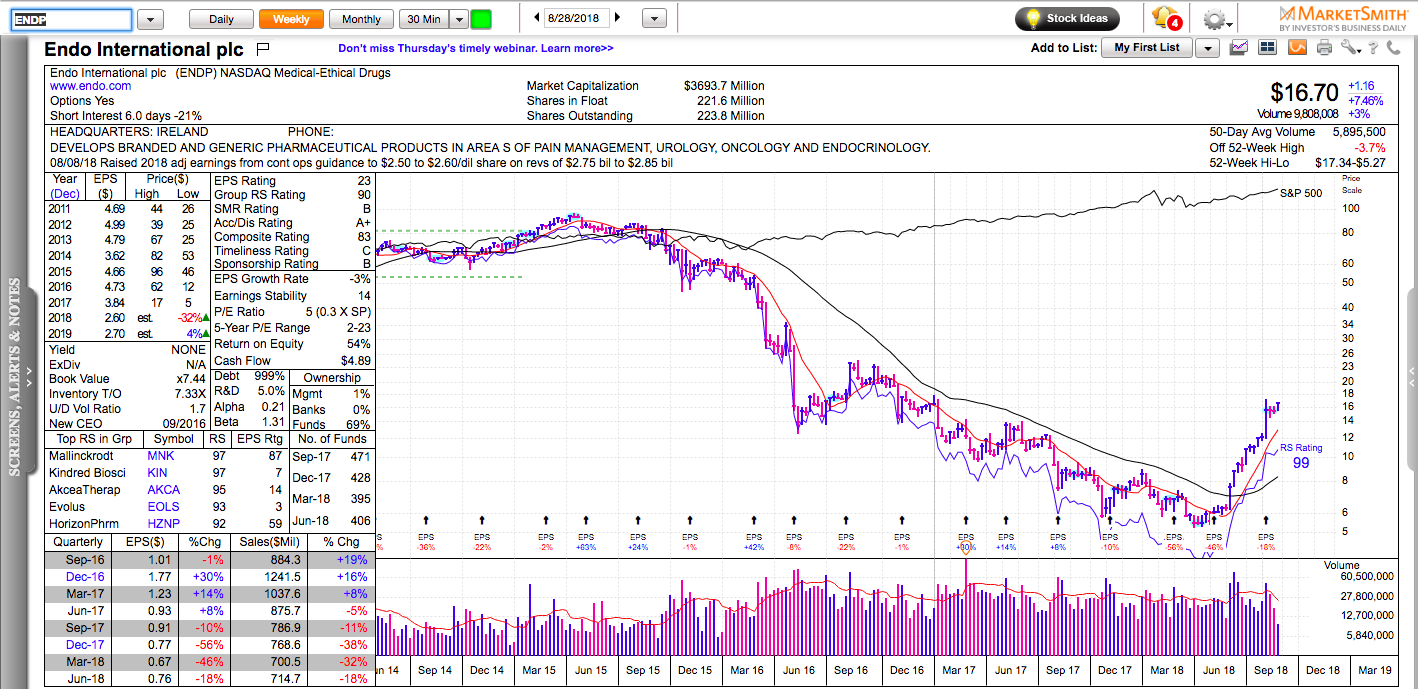

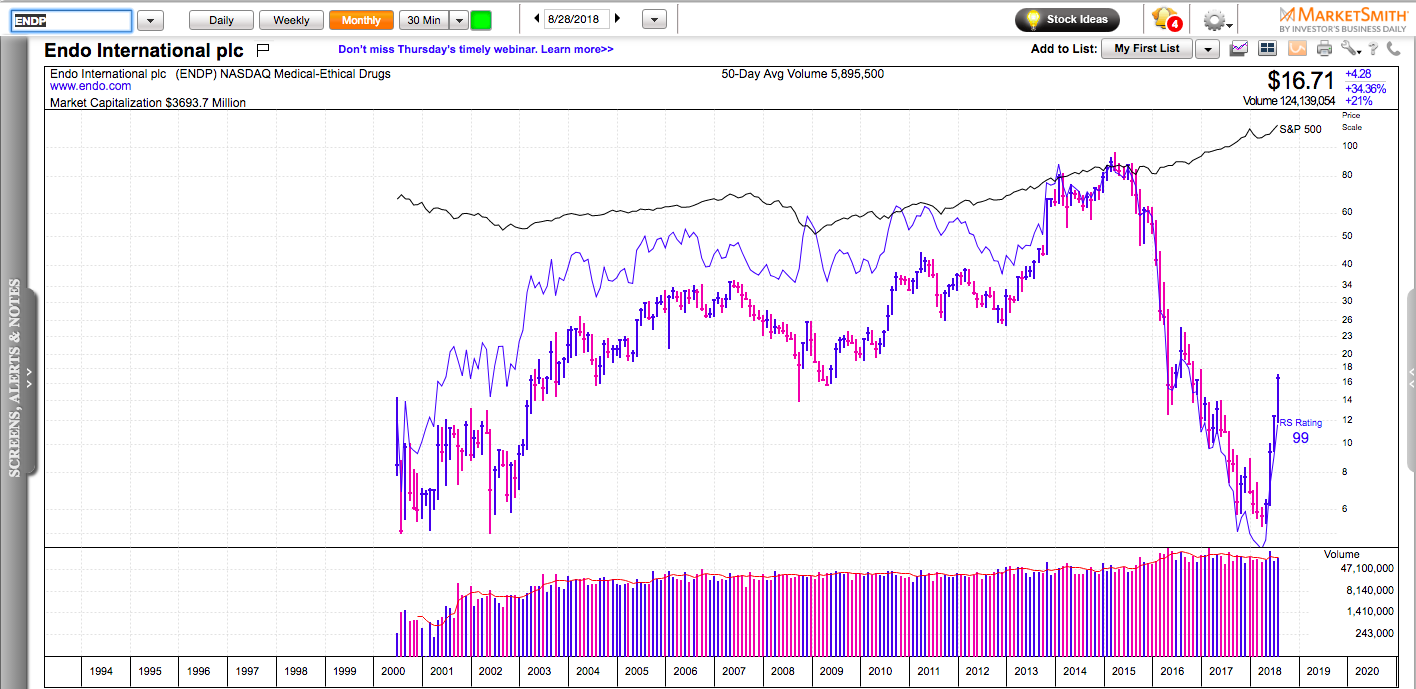

All charts on Momentum Monday are powered by MarketSmith

The bull market continues to rage with full force. Apple has been unstoppable after its earnings gap and it’s already a 1.1-trillion-dollar company. It is looking extended to chase here. Amazon is less than 2% away from becoming the next trillion-dollar company.

We continue to see strength in enterprise software, semiconductors, cybersecurity, retailers, and more recently – biotech. After quadrupling between 2012 and 2015, the biotech ETF, IBB has spent the last four years building a new base and it is not too far from making new all-time highs. The smaller-cap biotech ETF, XBI has already passed that milestone. The renewed interest in marijuana stocks has brought new life to the whole biotech sector. It might remain in play for a long time.