All charts are powered by MarketSmith.

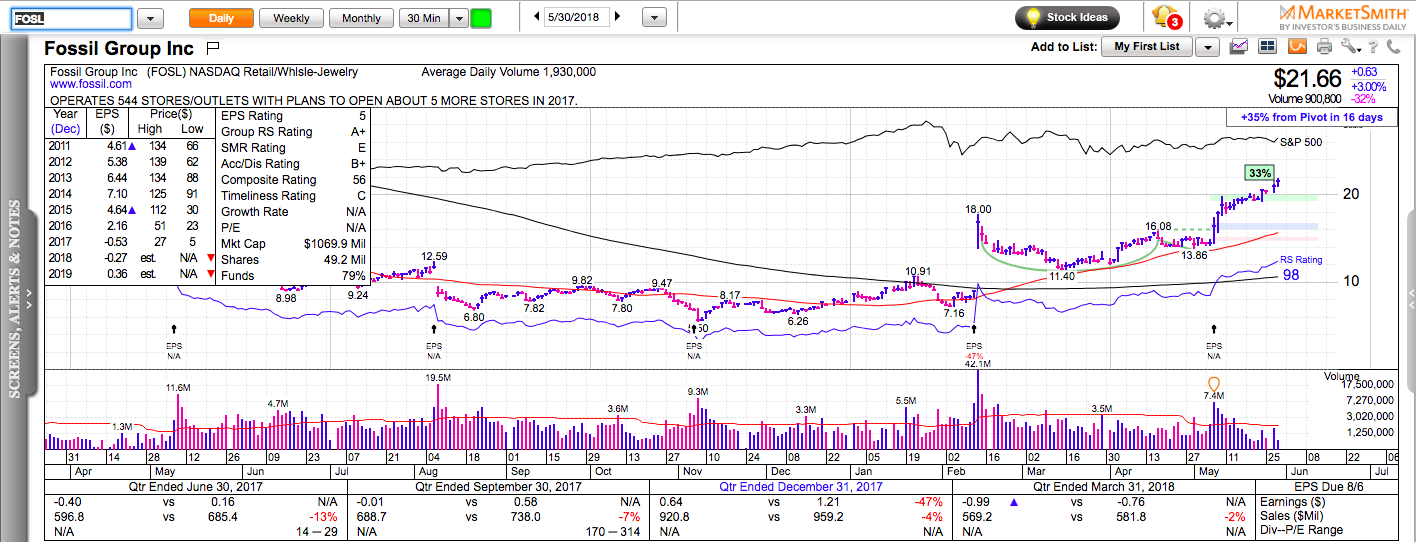

FOSL which is up 170% year-to-date which makes it the best-performing S&P 500 stock so far. Who would’ve thought that a watch-maker would be one of the price leaders in 2018? Probably, no one. This is one of the reasons why it is happening.

The best-performing stocks in any given year are usually the ones that surprise the most which mean that they are either:

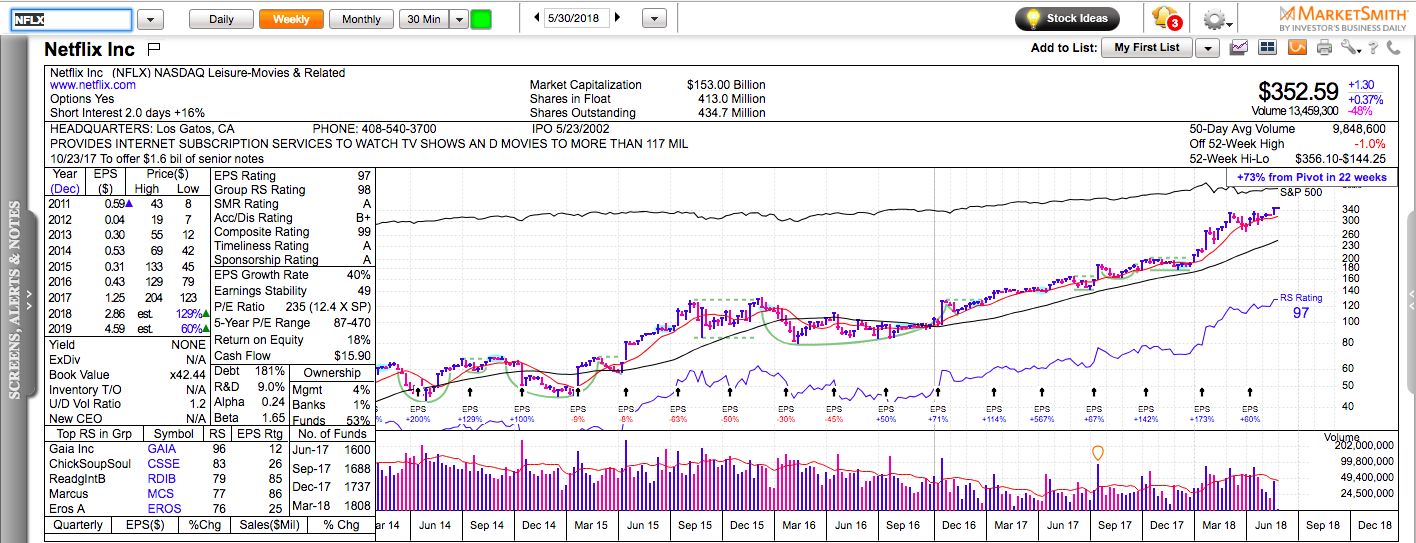

A) High-growth stocks that keep growing much faster than most analysts expect. They have established a powerful price momentum and no one believes they can possibly go any higher. NFLX is a good recent example.

Or

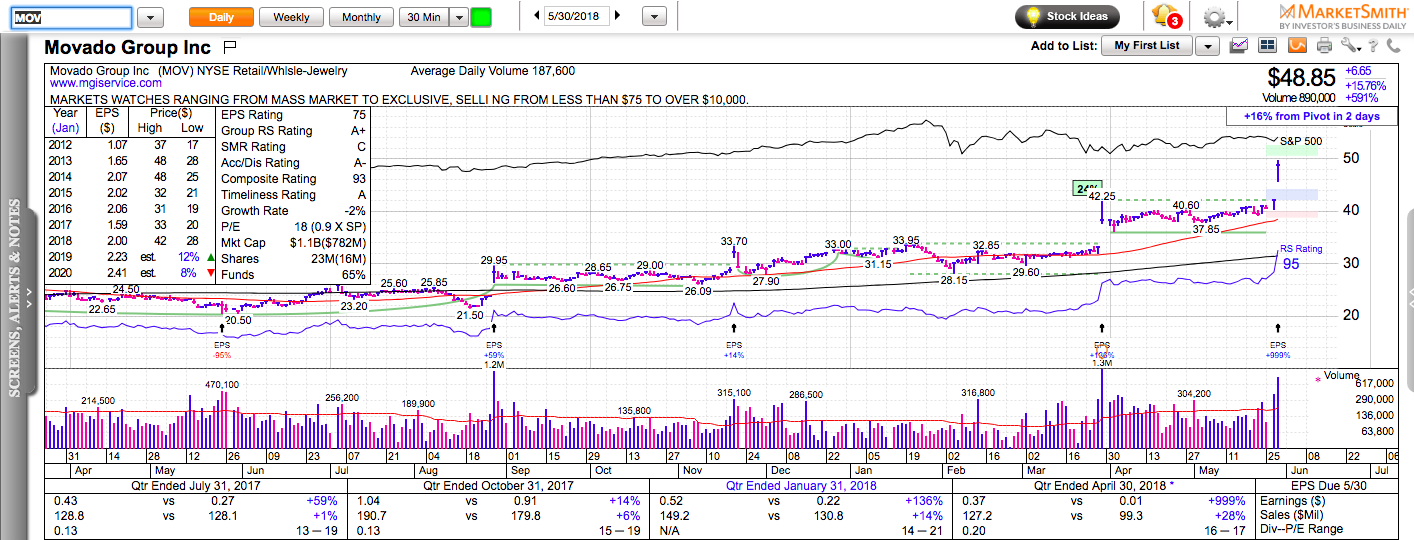

B) They come from an industry with extremely low expectations and high short interest. Extremely low expectations are easier to beat by a wide margin and high short interest is a potential fuel for higher prices because short sellers eventually will cover their bets (the question is if they will do it voluntarily when a stock sells off or involuntarily when a stock rallies and their bets are squeezed higher). FOSL and MOV are good recent examples.

Low expectations + New 52-week High can be a powerful combination.

Think about it. What’s your most likely reaction when you see a stock from low-expectations industry make new 52-week highs? You are very likely to dismiss the price action and think that the market must have gone crazy.

All trends need skeptics and doubters otherwise there would not be anyone left to buy.

When I highlighted MOV on Momentum Monday ten days ago, Howard’s reaction was: “Don’t they make watches? I am not interested in that stock”. His reaction made me smile. Almost every time when I highlight a great technical setup that Howard doesn’t like for fundamental reasons, the stock in question ends up making a significant move higher.

Today, MOV broke out to new 52-week highs after beating earnings estimates by 240%!

I don’t know what the future of FOSL and MOV is. I don’t use their products. Maybe, this year’s rally is just a temporary blip and the gradual adoption of smartwatches like Apple will end up being an extinction process for Fossil and Movado. What I know is that we should be paying attention to stocks from unpopular industries making new 52-week highs. Sometimes the market as a whole is smarter than its individual parts.