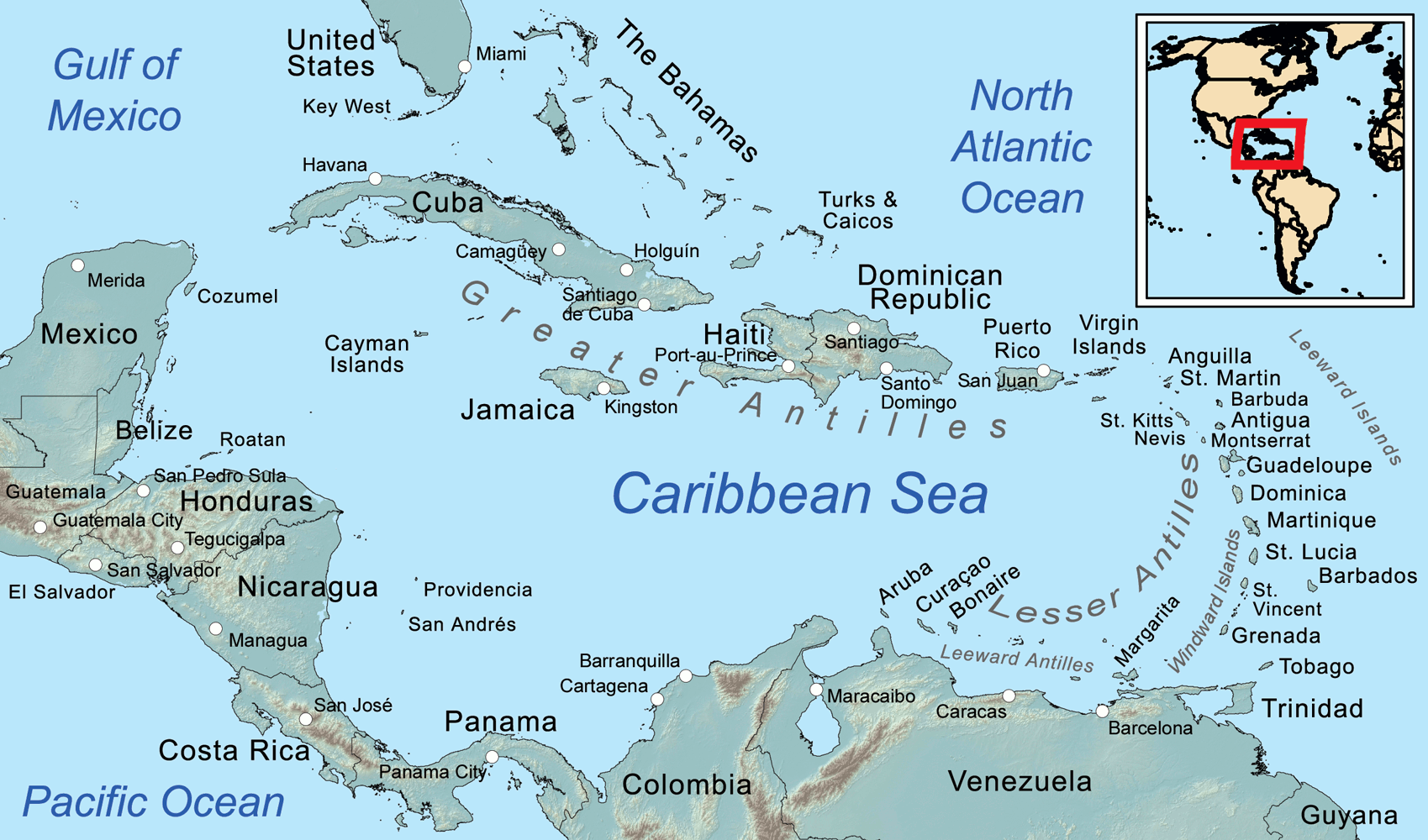

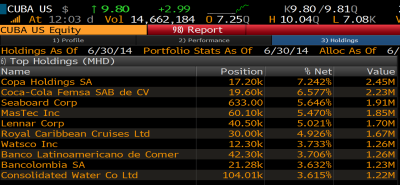

A couple weeks ago, President Obama announced that he is ready to relax restrictions for Cuba. The result – a little-known closed end fund trading under the symbol $CUBA skyrocketed. On December 17, it traded 48 times its average daily volume. In the midst of the very same trading day, some of the most read financial bloggers pointed out that CUBA’s current holdings might have very little to do with Cuba.

This fact didn’t stop $CUBA from doubling in five trading days. At some point it was trading at 70% premium above its net asset value, which basically means that everyone could’ve bought $CUBA individual holdings for a lot less. This phenomena didn’t last long. Warren Buffett once said “Time is the friend of the wonderful business, the enemy of the mediocre.” The same thing applies to stocks and ETFs, sometimes.

The big questions here are, why did the market over-react so much and why did it take so much time to correct the excess? In the era of social media, when everyone is supposed to have access to more information (noise) and higher quality analysis, we continue to see the same over-reactions and under-reactions as 10-20 years ago.

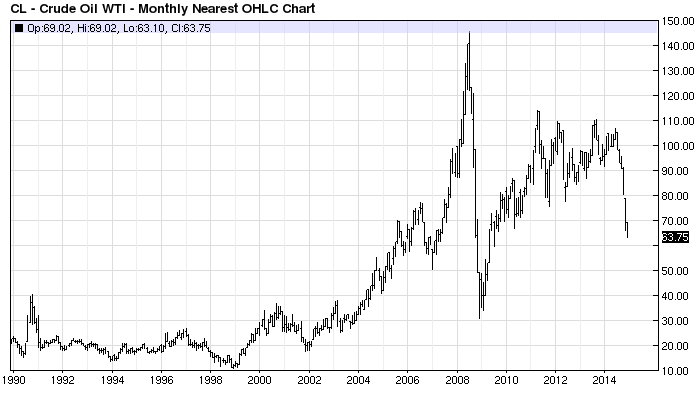

In the case of Cuba, people knew that those changes mean repricing. When people and algos have no idea how to play a change, they go with the next best thing – price and volume. Here’s what was probably going on in the mind of a shrewd speculator: “$CUBA is going up on huge volume, so somebody must know something. Even if the market turns out to be wrong, I will be out with a hefty profit long before that. It’s all about risk and reward.”

Intra-day traders and algorithms act on price, volume, key words and momentum and they have plenty of purchasing power to create powerful moves. Those moves are often exacerbated by early short-sellers, who don’t know when to step away from the freight train. Do you remember the huge rallies in ebola related stocks in October, when we saw 100% to 500% moves in less than two weeks?

Sometimes, ignorance is a bliss. The people who made the most money in the late 90s were those who knew nothing (not sure if they kept it) and those who knew a lot, but also knew when their knowledge was a hurdle.

Market is forward-looking, but sometimes it goes a little bonkers. You could complain about its irrationality or accept it as an inherent part of what it is and create a system that could take an advantage of it.

Check out my latest book: “The 5 Secrets to Highly Profitable Swing Trading”